Venionaire Capital

Press Contact

Chief Marketing Officer

Julia Gülden-Zeisberger

Julia is an experienced marketing expert with a demonstrated history of successfully working in various industries and has therefore long-standing expertise in planning, creating and implementing marketing and communication strategies.

She is your contact person concerning all journalistic matters, questions about the Venionaire Group and our team.

Email: julia@venionaire.com

Phone: +43 664 4387070

Press Kit

Venionaire’s Press Kit provides all information about the Venionaire Group, its affiliated companies, facts and figures, as well as the company’s history and vision at a glance.

Die Pressemappe von Venionaire enthält alle Informationen über die Venionaire-Gruppe, ihre verbundenen Unternehmen, Fakten und Zahlen sowie die Unternehmensgeschichte und -vision auf einen Blick.

Text / Logos / Images

ABOUT

Venionaire is a entrepreneurial partner for investors, founders and institutions. Our partners and team are undoubtedly specialized in Venture Capital and Private Equity investments, with an extensive track-record over more than a decade. We offer transaction and corporate advisory services – from due-diligence, valuation, deal structuring, (ghost) negotiating to alternative fund management – for investors, corporates, public entities and growth companies (startups / scaleups). Our track-record as entrepreneurs, advisors and investors shows deals in fields of corporate finance (M&A), (corporate) venture capital, corporate startup engagement (CSE), digital transformation and high-tech innovation with a total volume of more than a billion Euros. In addition we serve as trusted partners for scouting, screening, technology-, market- and competitive analysis and valuation for bespoke investors and accelerators in Europe. We are proud of our performance within managed portfolios and increase our high-tech footprint everyday to support a future-proof economy.

2017, Partners from Venionaire Capital and KPMG Austria founded European Super Angels Club. Inspired by the idea to connect Europe in order to shed light on the greatest talents of the European Union and provide necessary funding as a pan-european syndicate with the goal to see them conquer the world, we agreed to start this project. With this purpose in mind Liechtensteinische Landesbank (originally Semper Constantia Private Bank), Deutsche Börse Venture Network, top international law-firms like sheppherd-wedderburn, Accelerators like Wayra (Telefonica) and many others supported this club from early days until today. Every year roughly 40 Startups pitch in-front of a selected group of investors and some of them raise millions through this initiative and its syndication-fund.

Business Angel and even Venture Capital investing started in fact late in Europe. We didn’t trigger this trend, but we obviously identified a gap in 2014 together with Dr. Herwig Rollett and a number of Universities accross Europe. Most academic papers in the field of angel and venture finance where based on data from the United States of America and United Kingdom (in particular Scotland). European policy needed data to define attractive programs to support and build startup ecosystems and there was a need from academics to help identify investors to support studies and surveys. Years later Europe does significantly well in this sector and our initiative is not only supporting academia, it is furthermore training and certifing business angels to “CERTIFIED BUSINESS ANGELS“. Since July 2025 the Business Angel Institute is part of the World Venture Forum Foundation.

Management

Managing Partner

Berthold Baurek-Karlic

ENGLISH

Berthold Baurek-Karlic is Managing Partner (CEO) and Founder of Venionaire Capital AG, a globally active, independent investment firm specialized in private equity and venture capital. The Venionaire Capital group includes two fund management entities (AIFMs) based in Austria and Luxembourg, several subsidiaries and international offices, the valuation software provider DEALMATRIX (dealmatrix.com), and a direct investment portfolio focused on tech and deep tech.

In addition, he is the Founder and Secretary General of the Business Angel Institute (businessangelinstitute.org), President of the European Super Angels Club (www.superangels.club), a Board Member at UK-based Fraudfinder Ltd. (www.fraudfinderai.com), Board Member at Switzerland-based Eloop Foundation (Teneo Protocol – teneo.pro), Chairman of the Supervisory Board at Blockpit AG (blockpit.io), and Initiator and President of the World Venture Forum Foundation (www.worldventureforum.info).

In 2023, Berthold Baurek-Karlic received the “Austrian Business Angel of the Year 2023” award for his longstanding contributions to the startup ecosystem and his exemplary international commitment to collaborative innovation.

DEUTSCH

Berthold Baurek-Karlic ist geschäftsführender Gesellschafter (CEO) und Gründer der Venionaire Capital AG, einer weltweit tätigen, unabhängigen Investmentgesellschaft, die auf Private Equity und Venture Capital spezialisiert ist. Zur Venionaire Capital Gruppe gehören zwei Fondsgesellschaften (AIFMs) mit Sitz in Österreich und Luxemburg, mehrere Tochtergesellschaften und internationale Niederlassungen, der Anbieter der Bewertungssoftware DEALMATRIX (dealmatrix.com) sowie ein Direktbeteiligungsportfolio mit Fokus auf Technologie und Deep Tech.

Darüber hinaus ist er Gründer und Generalsekretär des Business Angel Institute (businessangelinstitute.org), Präsident des European Super Angels Club (www.superangels.club), Vorstandsmitglied bei dem in Großbritannien ansässigen Unternehmen Fraudfinder Ltd. (www.fraudfinderai.com), Vorstandsmitglied bei der in der Schweiz ansässigen Eloop Foundation (Teneo Protocol – teneo.pro), Vorsitzender des Aufsichtsrats der Blockpit AG (blockpit.io) sowie Initiator und Präsident der World Venture Forum Foundation (www.worldventureforum.info).

Im Jahr 2023 wurde Berthold Baurek-Karlic für seine langjährigen Verdienste um das Startup-Ökosystem und sein beispielhaftes internationales Engagement für kollaborative Innovation als „Austrian Business Angel of the Year 2023“ ausgezeichnet.

Press Releases & Clippings

28.01.2026

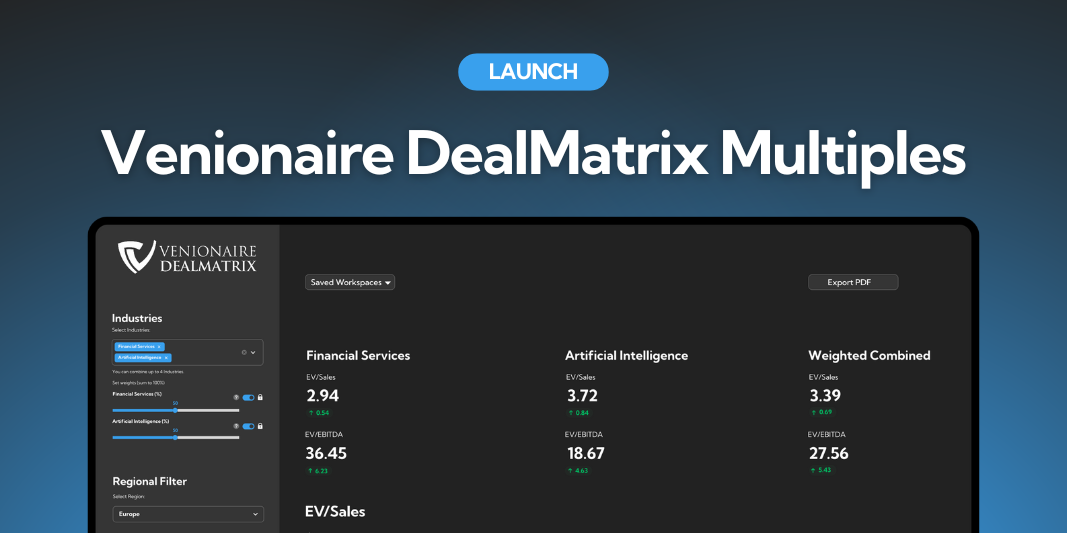

Venionaire DealMatrix launches “Venionaire DealMatrix Multiples” – time series-based PE and VC valuation multiples filtered by sector, company phase, and region

Venionaire DealMatrix, a subsidiary of Venionaire Capital, announces the launch of Venionaire DealMatrix Multiples. The new product provides private equity and venture capital multiples (EV/Sales and EV/EBITDA) covering over 140 sectors, allowing granular filtering by company stage from pre-seed to Series E and global regions, and tracking their development over time. This creates a robust reference framework for valuing private companies.

Mehr

In the media

05.11.2025

Compass Financial Technologies and Venionaire Capital AG announce Europe’s first onchain Index, powered by Reserve

Venionaire Capital AG, an Austrian investment firm, together with Swiss index provider, Compass Financial Technologies, today announce the launch of the Venionaire Layer-1 Select Index (VLONE) on November 11th, a European-developed Decentralized Token Folio (DTF) that brings institutional governance and benchmark-grade quality to the blockchain. Powered by Reserve, a platform for decentralized token folios, originally backed by investors, Peter Thiel and Sam Altman, VLONE makes digital asset indexing transparent, automated, and globally accessible to crypto investors.

Mehr

In the media

13.10.2025

Is Klagenfurt, Austria, A Model For The Circular Economy?

Investors, take note: the circular economy can make money. On October 14 in Brussels, a proven model from Klagenfurt will show how cities can turn waste and energy solutions into scalable investments. For years, circular economy initiatives—reusing and recycling as much as possible—stayed mostly on paper. Few became money-making ventures. But in Klagenfurt, a mid-sized Austrian city designated as one of the EU’s 100 climate-neutral cities, a three-year pilot shows that circular models can be financially viable when utilities, innovators, and investors collaborate.

Mehr

In the media

06.10.2025

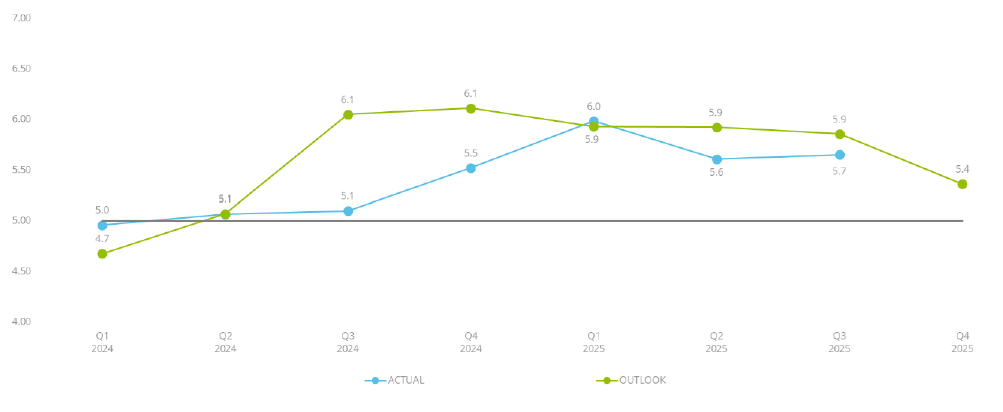

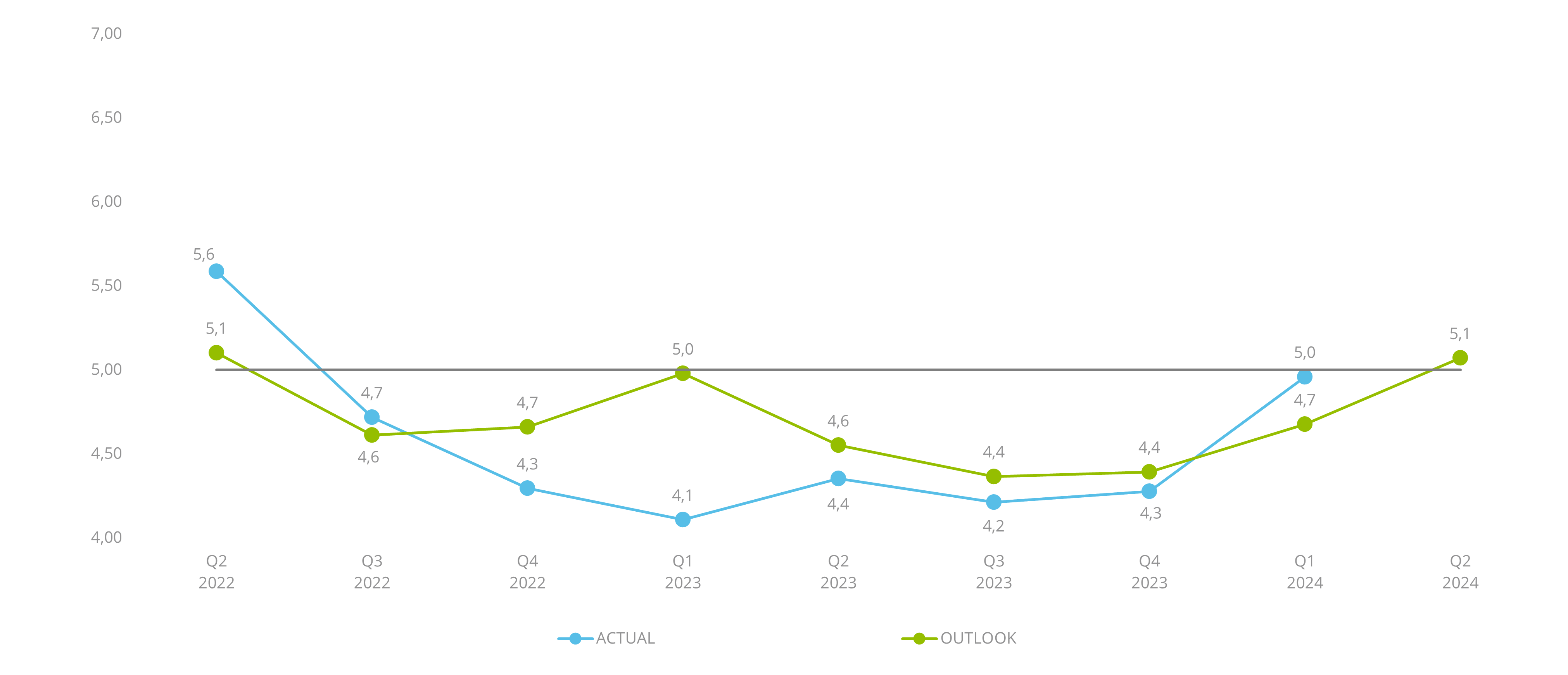

EVSI report: Investors are putting more money into fewer startups (German)

Venionaire’s European Venture Sentiment Index tracks investment activity and sentiment among top European investors every quarter and provides an outlook on what the startup industry can expect. After a strong start to the year, the environment for investment and financing is becoming increasingly challenging. Fewer but larger financing rounds are increasing the total transaction volume, but leaving young startups without capital. This is a short-term risk-minimizing measure, but one that has the potential for long-term consequences, according to Berthold Baurek-Karlic, CEO of Venionaire Capital AG: “Those startups that are now lacking capital would have been the up-and-coming scale-ups of tomorrow.”

Mehr

25.09.2025

Vienna Blockchain Week 2025: Bybit and Venionaire make big announcements in Vienna

From September 9 to 11, 2025, Vienna was all about blockchain, DeFi, and tokenization: Vienna Blockchain Week 2025, organized by DLT Austria, brought together more than 400 participants from over 35 countries, around 70 speakers, and numerous companies and investors at the Web3 Hub Vienna (District Working). In addition to the thematic focus on security & forensics, compliance & regulations, Bitcoin & mining, stablecoins, DeFi, and tokenized assets, two major announcements dominated the conference: Bybit presented its new debit card for the EU market, and Venionaire Capital introduced the first regulated layer-one crypto index.

Mehr

In the media

21.09.2025

Launch of the Venionaire Layer One Select Index (VLONE)

In traditional financial markets, indices such as the S&P 500, NASDAQ, or DAX have played a central role for decades. They serve as benchmarks for fund managers, facilitate portfolio comparisons, and provide investors with a quick overview of market sentiment. In the crypto market, however, a comparable reference structure has been lacking until now. Many funds measure their performance against Bitcoin, but this benchmark is insufficient. A fund with a focus on DeFi, gaming, or infrastructure projects cannot reasonably use Bitcoin as a meaningful point of comparison. This highlights the need for sector-specific and differentiated indices that provide a more accurate reflection of the market.

Mehr

In the media

20.09.2025

These 6 business angels provide support with their experience and network (German)

The profil stage offers visibility, recognition, and momentum. This in itself is a great added value for a young, innovative project. But the zeig profil award offers winners another decisive bonus: six business angels are ready to mentor the teams. Business angels are more than just investors. They are experienced entrepreneurs who invest their knowledge, their network, and their time. Their goal: to support founders on the often rocky road from the first pitch to international expansion.

Mehr

In the media

09.08.2025

These plans are being pursued by the new non-profit World Venture Forum Foundation (German)

Austria has been losing international competitiveness for years – the newly founded World Venture Forum Foundation aims to counteract this with educational initiatives and international networking. In this interview, CEO Berthold Baurek-Karlic talks about the foundation’s goals and the changing economic conditions.

Mehr

In the media

19.07.2025

DTF instead of ETF: Why tokenized indices are the next big thing (German)

Decentralized traded funds (DTFs) could become a game changer for the crypto retail market. In an interview with BTC-ECHO, Venionaire Capital CEO Berthold Baurek-Karlic explains how Europe is forging ahead in terms of regulation—and why an ETF on the blockchain is more than just a technical update.

Mehr

In the media

17.07.2025

Q.ANT raises €62 million to transform the future of computing with photonic processing

Q.ANT, a pioneer in photonic processing, today announced a €62 million Series A financing round to accelerate the commercialization of its energy-efficient photonic processors for artificial intelligence (AI) and high-performance computing (HPC). The round is co-led by Cherry Ventures, UVC Partners, and imec.xpand, with participation from additional deep tech investors, including L-Bank, Verve Ventures, Grazia Equity, EXF Alpha, LEA Partners, Onsight Ventures, and TRUMPF. This investment ranks among Europe’s most significant deep tech funding rounds, laying the foundation for a fundamental shift in how AI is computed.

Mehr

03.07.2025

New non-profit World Venture Forum Foundation promotes entrepreneurship and business location (German)

For 30 years, Austria has been struggling with a decline in global competitiveness. To counteract this trend, the non-profit World Venture Forum Foundation has now been established. In accordance with the foundation’s purpose, a new scientific, social, and economic environment is to be created that will enable Austria—among other things through international partnerships—to remain attractive and competitive as a center of science, technology, and business in the future.

Mehr

13.06.2025

Trust as capital: Why personal relationships are becoming increasingly important in investments (German)

In times of global tensions, fragmented markets, and growing reluctance among institutional investors, a traditionally underestimated factor is coming into focus: trust. For those seeking capital as well as those providing and managing it—on the one hand, wealthy individuals, foundations, and institutional investors, and on the other, private banks, for example—it is more important than ever to cultivate reliable relationships. After all, personal interaction is one of the key factors for success in business. The World Venture Forum, which takes place in Kitzbühel from June 30 to July 5, offers international investors and decision-makers a platform to establish and deepen global connections.

Mehr

04.06.2025

WVF 2025: How family offices operate in times of crisis (German)

Geopolitical uncertainties, cautious venture capitalists, and volatile financial markets: times have been better for innovative companies looking to find investors. Yet investments in times of crisis often offer the highest growth potential after a crisis. In such lean times, however, family offices can play to their strengths. They do not seek the limelight, show courage in their investments, have sufficient capital at their disposal, and leverage their entrepreneurial heritage. They often invest in industries with social added value and have a longer-term investment horizon than traditional venture capital or private equity funds. Many of these discreet investors meet annually at the Family Office Alm at the World Venture Forum 2025 in Kitzbühel.

Mehr

27.05.2025

World Venture Forum 2025: Tyrol becomes a hotspot for international investors (German)

Under the motto “Creating Global Relations,” the World Venture Forum (WVF) will hold its eleventh edition from June 30 to July 5, featuring a number of new developments. From its origins as a networking event for the European Super Angels Club, the WVF has evolved in recent years into a hub for top international investors. More than 500 guests from all over the world are expected to attend the event, which will take place at an altitude of over 1,000 meters above sea level, with the aim of promoting the most innovative technologies and companies and creating new connections.

Mehr

15.01.2025

EVSI report: Austria—a flash in the pan?

Record investments and cautious optimism for 2025 (German)

Venionaire’s European Venture Sentiment Index tracks the mood among top European investors every quarter and provides an outlook on what the startup industry can expect. After a weak third quarter in 2024, investments increased significantly again at the end of the year. Interestingly, Austrian companies were able to generate over $1 billion in investments. “We can be optimistic about the new year, but we shouldn’t expect miracles,” says Berthold Baurek-Karlic, CEO of Venionaire Capital AG, summarizing the outlook.

Mehr

07.11.2024

Bitcoin auf Allzeithoch – “Kurs wird weiter steigen”

Die US-Präsidentschaftswahlen sind der Höhepunkt eines Superwahljahres, in dem rund 3,5 Milliarden Menschen ihren neuen Staatschef wählen werden. Wahlen können jedoch nicht nur für die Bevölkerung, sondern auch für die Aktien- und Kryptomärkte entscheidende Momente sein. Igor Hadziahmetovic, Investment Director & Web3 Tech Lead bei Venionaire Capital, gibt Einblicke in die möglichen kurz- und langfristigen Auswirkungen auf den Kryptomarkt nach dem Wahlsieg von Donald Trump.

Mehr

In the media

10.10.2024

World Venture Forum Insider Circle: Neues Netzwerk für internationale Investor:innen

Der World Venture Forum Insider Circle bietet eine exklusive Plattform, die Investor:innen die Möglichkeit eröffnet, in ein einzigartiges, weltweites Netzwerk von Startups und Investor:innen einzutauchen. Mitglieder des Insider Circle haben die Möglichkeit, die wichtigsten Startup-Hubs, exklusive Konferenzen und Veranstaltungen zu besuchen und Verbindungen zu schaffen, wie sie im digitalen Raum gar nicht möglich sind.

Mehr

In the media

19.09.2024

Positive Investoren-Stimmung ist mit Vorsicht zu genießen

Der European Venture Sentiment Index von Venionaire erfasst jedes Quartal die Stimmung unter europäischen Top-Investoren und gibt einen Ausblick, was die Startup-Branche erwartet. Nach seinem Höchststand vergangenes Quartal, konnte er mit Ausblick auf das vierte Quartal 2024 sogar noch etwas zulegen. Berthold Baurek-Karlic, Vorstandsvorsitzender der Venionaire Capital AG, mahnt aber zur Vorsicht: „Nach über einem Jahr steigender Zuversicht, flacht die Kurve momentan etwas ab. Es könnte für Startups schwer werden, noch passende Investments vor Jahresende zu finden.“

Mehr

19.09.2024

„Innovation entsteht dort, wo der Wille dafür da ist“: Venionaire Capital unterstützt Klagenfurter Startup-Initiativen

„Innovation entsteht dort, wo der Wille dafür da ist. Und in Klagenfurt gibt es davon mehr als genug“, so Berthold Baurek-Karlic, Vorstandsvorsitzender der Venionaire Capital AG und Austrian Business Angel of the Year. Im Rahmen des Kick-Off-Events ‚Beyond the Future‘, organisiert vom Alpen-Adria Business Club (AABC), beleuchtete Baurek-Karlic Chancen für Unternehmen und Gründer in der Kärntner Landeshauptstadt.

Mehr

In the media

09.07.2024

Venionaire & European Super Angels Club feiern Exit: STS Digital erwirbt flovtec

STS Digital, ein auf den außerbörslichen Handel und das Market Making von digitalen Vermögenswerten spezialisiertes Unternehmen, übernimmt flovtec, einem in der Schweiz ansässigen Market Maker für digitale Vermögenswerte und Portfolio-Unternehmen des European Super Angels Club (ESAC). Venionaire Capital spielte eine entscheidende Rolle bei der Beratung zu diesem Deal. Der EXF Alpha S.C.S Fund, der Syndikatsfonds des European Super Angels Club (ESAC), verwaltet von der Venionaire Ventures S.à r.l. mit Sitz in Luxemburg, war direkt beteiligt.

Mehr

In the media

09.07.2024

World Venture Forum 2024: „Wir brechen in ein neues Zeitalter auf“

Das zehnte World Venture Forum (WVF) brachte Top-Investor:innen und Expert:innen aus aller Welt nach Kitzbühel. Fünf Tage, gefüllt mit spannenden Diskussionen, Keynotes und Netzwerkmöglichkeiten, brachten einen neuen Besucherrekord. Über 500 Teilnehmer:innen tauschten sich verteilt über eine Woche zu Trends und Innovationen rund um die Kryptobranche, Family Offices, Corporate Innovation und Deep Tech aus und konnten einiges mitnehmen.

Mehr

13.06.2024

World Venture Forum: Internationale Top-Investoren treffen sich in Kitzbühel

Unter dem Motto „A Decade of Transformation“ feiert das World Venture Forum (WVF) von 1. bis 7. Juli sein zehnjähriges Bestehen in Kitzbühel. Vom Netzwerktreffen des European Super Angels Club entwickelte sich das WVF in den letzten Jahren zu einem der Verknüpfungspunkte für internationale Top-Investorinnen und Investoren. Mehr als 500 Gäste aus aller Welt werden erwartet, wenn es auf über 1.000 Metern Seehöhe wieder darum gehen wird, die innovativsten Technologien und Unternehmen voranzutreiben.

Mehr

19.04.2024

Circular Economy Day 2024 in Klagenfurt: Startschuss für 20 Millionen InvestCEC-Fonds

Der Circular Economy Day 2024, präsentiert von den Stadtwerken Klagenfurt im Rahmen des EU-Projekts InvestCEC, war ein herausragender Erfolg. Über 30 Teilnehmer:innen nahmen an diesem inspirierenden Event teil, das am 18. April 2024 im Lakeside Science & Technology Park stattfand. Die Finalisten des InvestCEC Pitch-Wettbewerbs, der im Rahmen des Projekts ausgelobt wurde, um das Potenzial der Zusammenarbeit mit Startups für die Stadtwerke Klagenfurt zu evaluieren, hatten Gelegenheit, sich vor einer Fachjury der Projektpartner Venionaire Capital AG und Stadtwerke Klagenfurt AG zu beweisen.

Mehr

In the media

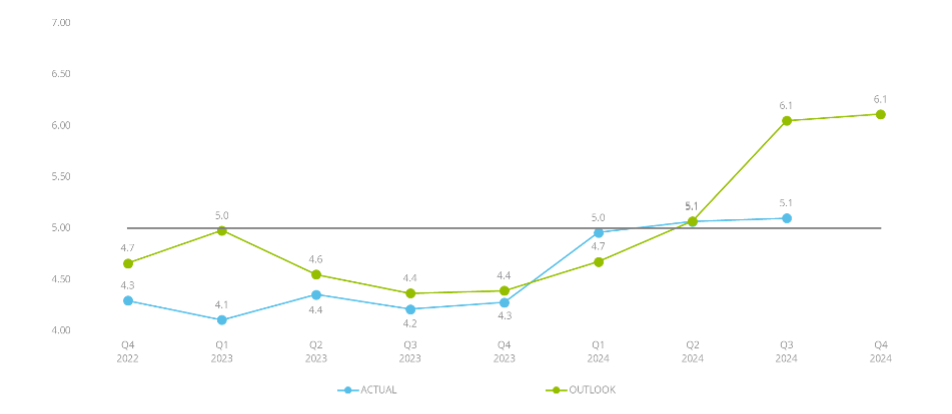

15.04.2024

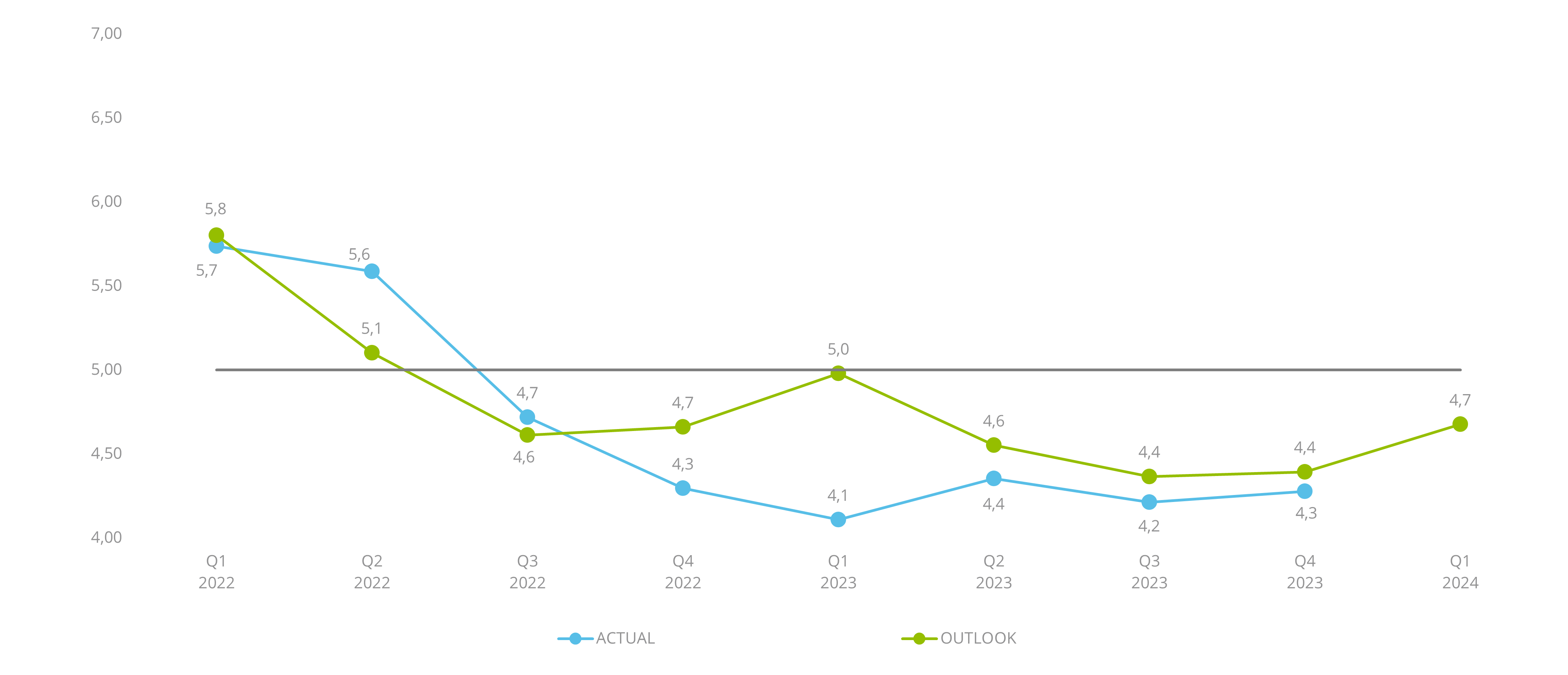

Erwartungen übertroffen: European Venture Sentiment Index auf höchstem Stand seit Ausbruch des Russland-Ukraine-Konflikts

Nach zwei schweren Jahren am Risikokapitalmarkt, hat der European Venture Sentiment Index von Venionaire eine Besserung für das Jahr 2024 vorausgesagt. Im ersten Quartal 2024 konnten die Erwartungen der europäischen Risikokapitalgeber sogar übertroffen werden. Auch für das zweite Quartal stehen die Vorzeichen gut – mit möglichen Hindernissen.

Mehr

In the media

25.01.2024

Wieder mehr Risikokapital für Start-ups: „European Venture Sentiment Index“ stellt Investment-Trendwende in Aussicht

Zwei herausfordernde Jahre liegen hinter der europäischen Start-up-Szene, deren innovative Jungunternehmen zunehmend an der Finanzierung scheiterten. 2024 dürfte sich die Lage deutlich entspannen – so deutet es der „European Venture Sentiment Index“ von Venionaire an, der die Investment-Präferenzen von Risikokapitalgeber:innen und Business Angels abbildet und prognostiziert.

Mehr

In the media

18.12.2023

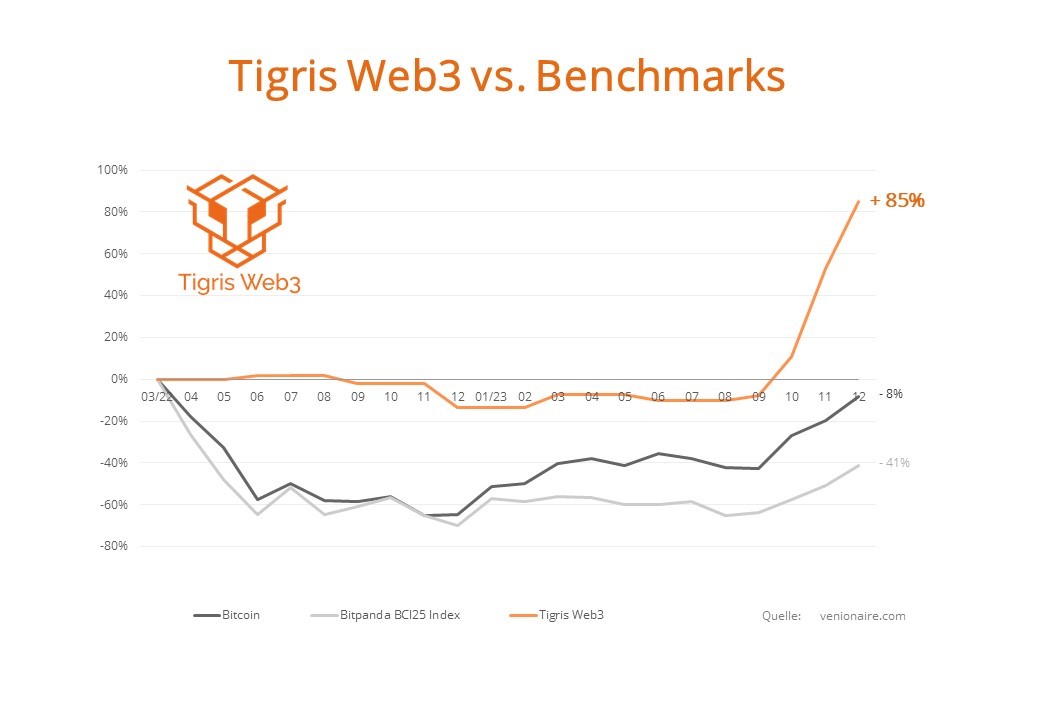

Österreichs einziger Kryptofonds Tigris Web3 mit 85 Prozent im Plus, Ausblick positiv

Nach eher rauen Monaten für die Kryptobranche mit prominenten Firmenpleiten zeigt sich ein beginnender „Krypto-Frühling“. Spekulationen über große Bitcoin ETFs, die zunehmende Institutionalisierung und Regulierung sowie technologische Innovationen sorgen für einen Aufschwung und zunehmendes Interesse an alternativen Investments.

Mehr

In the media

07.11.2023

Tauwetter nach Kryptowinter: European Super Angels Club (ESAC) gibt Übernahme von Accointing durch Portfoliounternehmen Blockpit AG bekannt

In einer Zeit, in der der Kryptomarkt nach wie vor großen Herausforderungen steht, unterstreicht der European Super Angels Club (ESAC) seine unerschütterliche Überzeugung von der Bedeutung und dem Potenzial des Krypto-Sektors und insbesondere des Web3. Der Vorstand des ESAC und das Fondsmanagement der Venionaire Ventures Sárl, mit Sitz in Luxemburg, geben daher heute stolz die eindrucksvolle Übernahme von Accointing durch das Portfoliounternehmen Blockpit AG bekannt.

Mehr

23.10.2023

Venionaire Capital wird zur Aktiengesellschaft

Venionaire Capital, eines der führenden Unternehmen im Bereich Venture Capital und Private Equity in Österreich, hat die Umwandlung zur Aktiengesellschaft (AG) abgeschlossen. Venionaire Capital setzt mit der strategischen Umwandlung der Rechtsform einen ambitionierten Schritt in Richtung europaweiter Sichtbarkeit, als Investmenthaus bzw. Fondsmanager mit Spezialisierung auf Innovation und Technologie, der auf einer breiten Aktionärsbasis aufbauen soll.

Mehr

In the media

21.09.2023

Cybertrap mit neuem Management und Investment neu aufgestellt

Das Wiener Cybersecurity-Unternehmen Cybertrap erhält eine Investition von über einer halben Million Euro vom European Super Angels Club (ESAC) und strebt unter neuer Führung einen internationalen Durchbruch an. Cybertrap ist in der DACH-Region bereits führend im Bereich Deception Tech, einer Technologie, die Angreifer in eine eigens geschaffene IT-Infrastruktur umleitet und ihre Aktivitäten verfolgt, ohne dass diese jemals die eigentliche Unternehmensinfrastruktur erreichen.

Mehr

In the media

15.09.2023

Berthold Baurek-Karlic ist “Business Angel of the Year Austria 2023”

Mag. Berthold Baurek-Karlic wurde im Zuge des 15. Business Angel Days zum „Business Angel of the Year“ in der Kategorie male gekürt. Der umtriebige Unternehmer und Investor fühlt sich mit dieser großen Auszeichnung sehr geehrt und möchte diese nutzen, um die Sichtbarkeit und Bedeutung nationaler Startups bzw. Unternehmer in der breiten Öffentlichkeit zu verbessern.

Mehr

In the media

12.09.2023

Salzburger e-Signatur Startup sproof erhält 3 Millionen von European Super Angels Club und Co-Investoren

Der European Super Angels Club (ESAC), rund um den österreichischen Präsidenten und Investor Berthold Baurek-Karlic, erhöht seine Beteiligung am Salzburger e-Signatur Startup sproof. Etwas mehr als 3 Millionen Euro wurden durch den Syndikatsfonds des European Super Angels Clubs, internationale Co-Investoren, sowie Förderungen der FFG investiert. Der Fonds des European Super Angels Club stärkt mit dieser Investmentrunde seine Rolle als größter Einzelinvestor, und will zukünftig das Unternehmen in Sachen Business Development noch intensiver über die Landesgrenzen hinaus unterstützen.

Mehr

In the media

19.04.2023

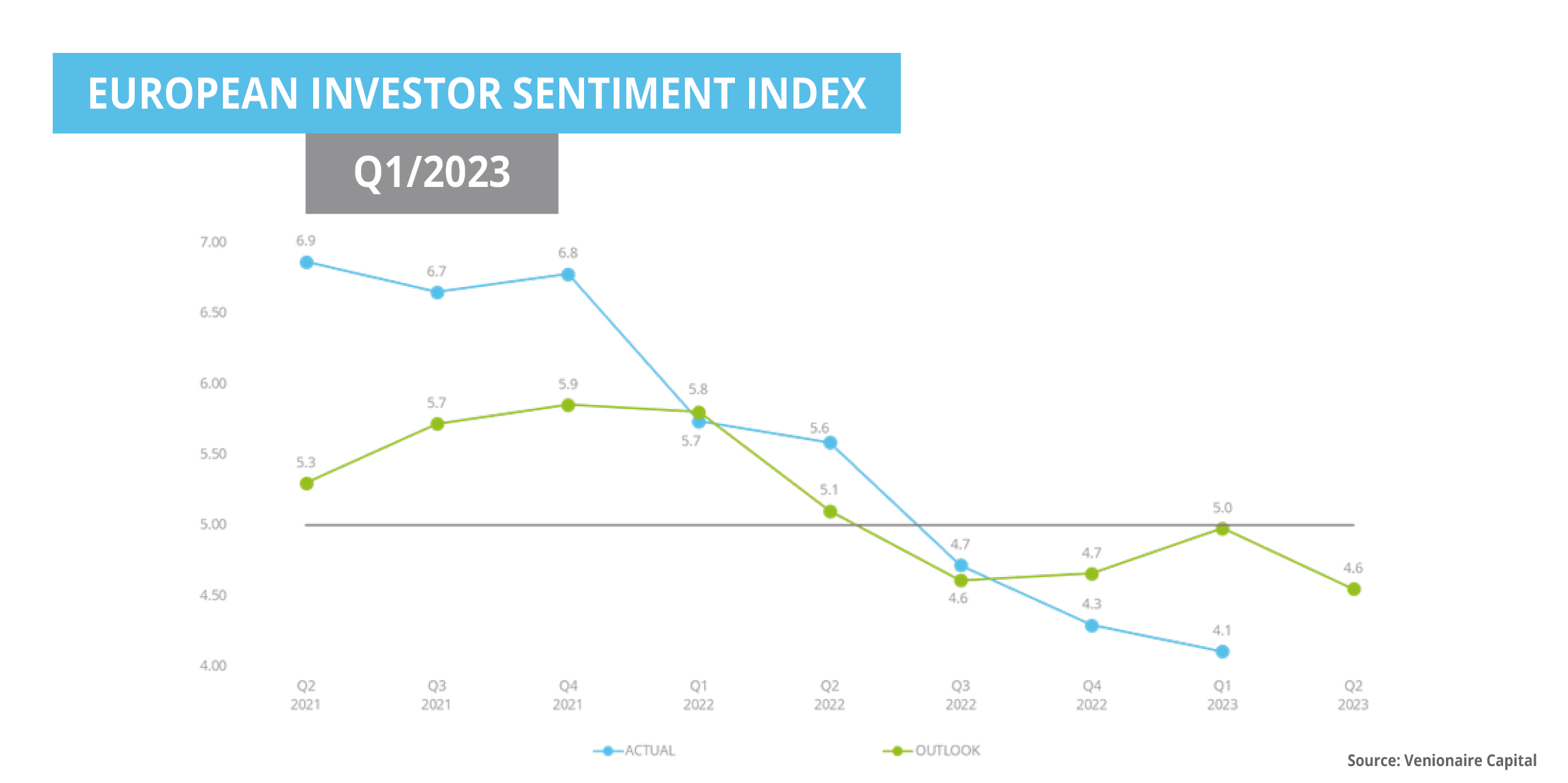

EVSI Report Q1 2023: Vertrauen in Europas Startup Sektor sinkt auf historischen Tiefststand

Der European Venture Sentiment Index (EVSI) wird von Venionaire Capital gemeinsam mit Netzwerkpartnern wie EY, dem European Super Angels Club (ESAC) sowie mehreren internationalen Angel Organisationen seit Q1 2020 quartalsweise erhoben. Dabei werden über 4.000 Risikoinvestor:innen aus den Bereichen Business Angels, Venture Capital und Family Offices in ganz Europa zu ihrer Markteinschätzung befragt. Noch im Q4 2022 erwarteten die Expert:innen, dass sich die Wirtschaft im Q1 2023 stabilisieren und im zweiten Halbjahr 2023 verbessern würdet. Die Realität offenbart jedoch ein anderes Bild.

Mehr

In the media

01.04.2023

Mit ChatGPT zum Chartstürmer? Wiener Startup-Investoren veröffentlichen KI-Song

Pünktlich zum 1. April mischt ChatGPT nun auch den österreichischen Musikmarkt auf: Heute wurde der KI-Song „Best in the Game“ released – eine englische Hip-Hop-Nummer des Wiener Neo-Künstlers „10x“, die mithilfe von ChatGPT verfasst wurde. Die Single wurde vom neuen Wiener Musiklabel Venionaire Rhythm Labs der Investmentgesellschaft Venionaire Capital produziert und versteht sich als Liebeserklärung an die Startup-Szene. Ab sofort auf Spotify, YouTube sowie zahlreichen Social-Media-Plattformen zu hören – und schon bald auch auf der Blockchain-Plattform TokenTraxx im Web3. Hat der ChatGPT-Song Chart-Potenzial? Am besten gleich reinhören!

Mehr

08.03.2023

World Venture Forum 2023: Kitzbühel statt Davos – Innovation statt Politik

Das World Venture Forum (WVF) 2023 findet von 3. bis 8. Juli 2023 in Kitzbühel statt und steht in diesem Jahr unter dem Motto „Boom & Bust“. Bereits zum 9. Mal versammeln sich internationale Investor:innen und Expert:innen rund um die Themen Crypto, Circular Economy, Life Sciences, LegalTech, Family Offices & Institutional Private Equity in Kitzbühel und tauschen sich auf über 1.000 Metern Seehöhe in verschiedenen Diskussionspanels und Round Tables zu den Schlüsselthemen in den Bereichen Innovation, Zukunft, High-Tech und Venture Capital aus.

Mehr

In the media

24.11.2022

Gitarrenlern-App Fretello Downloads explodieren verstärkt durch Kooperation mit Musik-Giganten Yamaha und Thomann

Nach zahlreichen internationalen Kooperationen – unter anderem mit Apple, Sony/ATV und EMI – startet das Linzer Gitarrenlern-Start-up „Fretello“ nun eine weitere Partnerschaft mit zwei globalen Giganten der Musikindustrie: Der international führende Musikinstrumente-Hersteller Yamaha und der weltweit größte Online-Gitarrenhändler Thomann bieten beim Kauf einer Gitarre nun erstmals ein kostenloses Probeabo von Fretello an.

Mehr

In the media

- Kronen Zeitung (24.11.2022)

- Brutkasten.com (24.11.2022)

- Trending Topics (24.11.2022)

- Wirtschaftszeit.at (24.11.2022)

- Weekend.at (24.11.2022)

- Leadersnet (24.11.2022)

- Meinbezirk.at (24.11.2022)

- Freizeit.at (24.11.2022)

- Unitednetworker.com (24.11.2022)

- gamebiz.org (24.11.2022)

- internetworld.at (24.11.2022)

- tips.at (25.11.2022)

- guitarworld.com (20.11.2022)

- assets-magazin.at (06.12.2022)

Circular Economy: Klagenfurter Stadtwerke und Venionaire starten EU-Projekt in Millionenhöhe

Der Startschuss für eines der wichtigsten EU-Projekte fiel am 17.11.2022. Venionaire Capital ist – gemeinsam mit den Stadtwerke Klagenfurt AG – stolzer Partner dieses zukunftsweisenden Vorhabens. Circular Economy (Kreislaufwirtschaft) ist der zentrale Dreh- und Angelpunkt des Konzeptes Green Deal, mit dem die Europäische Union die Netto-Treibhausgasemissionen bis 2050 auf Null reduzieren möchte.

Mehr

03.10.2022

Venionaire Capital feiert 10-jähriges Jubiläum: Von der Investment Boutique zum Vorreiter in der Finanzbranche

Highlight beim Wiener Private Equity und Venture Capital Spezialisten Venionaire Capital: Vor genau zehn Jahren gründete Managing Partner (CEO) Berthold Baurek-Karlic das Unternehmen und legte damit den Grundstein für den heutigen Erfolg. Dies wurde mit über 120 hochkarätigen Gästen gefeiert.

Mehr

20.09.2022

Victoria Woodland-Ferrari neue Associate Partnerin bei Venionaire Capital

Die internationale Private-Equity-Expertin Victoria Woodland-Ferrari (37) verstärkt seit Mitte September als neue Associate Partnerin den Venture Capital Spezialisten Venionaire Capital, mit Hauptsitz in Wien. Woodland-Ferrari bringt über zehn Jahre internationaler Erfahrung in Private Equity und Operations mit und hatte Funktionen wie Vice President in Secondary Private Equity bei Deutsche Bank oder CFO/COO bei Switchee inne.

Mehr

13.09.2022

Linde Verlag gründet Digital-Tochter

Der Linde Verlag werde neben etablierten Eigenentwicklungen zukünftig verstärkt auf die Zusammenarbeit mit und Beteiligungen an Start-ups für die Kernzielgruppe von Steuerberater:innen, Anwält:innen und Notar:innen setzen, heißt es in einer Aussendung. Strategische Beteiligungen, bei welchen auch spätere Akquisitionen nicht ausgeschlossen sind, sollen in Zukunft vermehrt direkt über die Linde Digital GmbH erfolgen.

Mehr

07.09.2022

Julia Gülden-Zeisberger ist neue Chief Marketing Officer bei Venionaire Capital

Seit Anfang September verstärkt Julia Gülden-Zeisberger (40) als neue Chief Marketing Officer den Venture Capital & Private Equity Spezialisten.

Mehr

In the media

- diepresse.com (14.09.2022)

- New Business Magazin (Oktober 2022)

- horizont.at (14.09.2022)

- wirtschaftszeit.at (13.09.2022)

- brutkasten.com (14.09.2022)

- top-leader.at (16.09.2022)

- extrajournal.net (14.09.2022)

- leadersnet.at (13.09.2022)

- archytele.com (15.09.2022)

- medianet.at (15.09.2022)

- ovationmagazin.com (03.10.2022)

22.07.2022

Neue, virtuelle Investment-Plattform: Crowdinvesting-Pionier CONDA digitalisiert Europas größtes Investorennetzwerk

Mehr als 50.000 CONDA-Crowdinvestoren können nun erstmals über den European Super Angels Club in Start-ups investieren – zum Auftakt ist eine bis zu 10 Millionen Euro schwere Investmentrunde geplant.

Mehr

11.05.2022

E-Carsharing Startup ELOOP erweitert Finanzierungsrunde und holt Bitpanda-Gründer als Investor an Bord

Ein Jahr nach seiner letzten Finanzierung erweitert der Wiener E-Carsharing-Anbieter ELOOP die Seed-Runde nun um rund eine weitere Million Euro. Angeführt wird die Seed Extension von den Bestandsinvestoren, dem European Super Angels Club sowie C&P Ventures. Neu dabei ist erstmals Bitpanda-Gründer und CTO Christian Trummer.

Mehr

03.05.2022

Ehemalige ÖBIB-Chefin Martha Oberndorfer wird neue Associate Partnerin bei Venionaire Capital

Martha Oberndorfer (59) verstärkt seit Mitte April als neue Associate Partnerin das auf Venture Capital & Private Equity spezialisierte Beratungs- und Beteiligungsunternehmen Venionaire Capital in Wien. Sie ist passionierte Investmentbankerin und internationale Kapitalmarktexpertin.

Mehr

26.04.2022

Gitarrenlern-App Fretello holt sich drei Millionen Euro Venture Capital

Fretello legt den Growth Overdrive ein und holt sich frisches Kapital für weiteres Wachstum: Die Gitarren-App erhält rund drei Millionen Euro Investment vom European Super Angels Club, dem finnischen Venture Capital Fonds Sparkmind, den Tractive-Mitgründern Michael Tschernuth und Michael Lettner sowie dem OÖ HightechFonds.

Mehr

25.03.2022

Venionaire Capital legt ersten österreichischen Kryptofonds auf

Der Wiener Venture Capital Spezialist Venionaire Capital legt mit „Tigris Web3“ den ersten österreichischen Kryptofonds auf, der zu 100 % in digitale Assets investiert. Nun wurde Tigris Web3 von der Finanzmarktaufsicht (FMA) als Alternativer Investmentfonds (AIF) registriert. Der Fonds wird in den revolutionärsten, technologischen, Paradigmenwechsel des 21. Jahrhunderts investieren, in sogenannte Web3-Protokolle, die das Fundament eines dezentralen Internets der Zukunft, frei von heutigen Tech-Giganten, bilden.

Mehr

In the media

- brutkasten.com (25.03.2022)

- trendingtopics.eu (25.03.2022)

- rechteasy.at (25.03.2022)

- derstandard.at (25.03.2022)

- fondsprofessionell.at (28.03.2022)

- thelegal500.com (30.03.2022)

- immo-timeline.at (28.03.2022)

- extrajournal.net (25.03.2022)

- fundscene.com (26.03.2022)

- skyrocketx.com (11.05.2022)

- deutsche-startups.de (29.03.2022)

- heute.at (26.03.2022)

- ffnews.com (11.05.2022)

- ress.at (25.03.2022)

WHERE TO FIND US

VIENNA, OFFICE (HQ)

Babenbergerstraße 9/12,

A-1010 Vienna, Austria (EU)

office@venionaire.com

SAN FRANCISCO, USA

1355 Market St. #488

San Francisco CA 94103

sfo@venionaire.com

NEW YORK CITY, USA

122 East 37th Street

First Floor

New York, NY 10016

nyc@venionaire.com

LONDON, UK

Gable House, 239 Regents Park Road

London N3 3LF

office@venionaire.com

MUNSBACH, LUX

3 rue Gabriel Lippmann

5365 Munsbach

office@venionaire.com

SITEMAP

LOOKING FOR FUNDING?

FOR STARTUPS

Venionaire Capital exclusively invests through the European Super Angels Club, for more information and application please go to the website. We do not accept direct investment proposals via this website.