Startup Investment Landscape in Q1 2021:

European Venture Investor Sentiment Hits a Record High

The quarterly survey published by Venionaire Capital reveals that European investor optimism hit a record high in Q1 2021.

But the report also issues a word of caution that the tide might be about to turn. While the mood in the investment landscape is expected to remain positive in the months to come, there are indications that the aggressive market may have reached its zenith.

Here’s a closer look at the trends from Q1 and expectations for the months ahead.

Q1 2021: Another booming quarter for investment

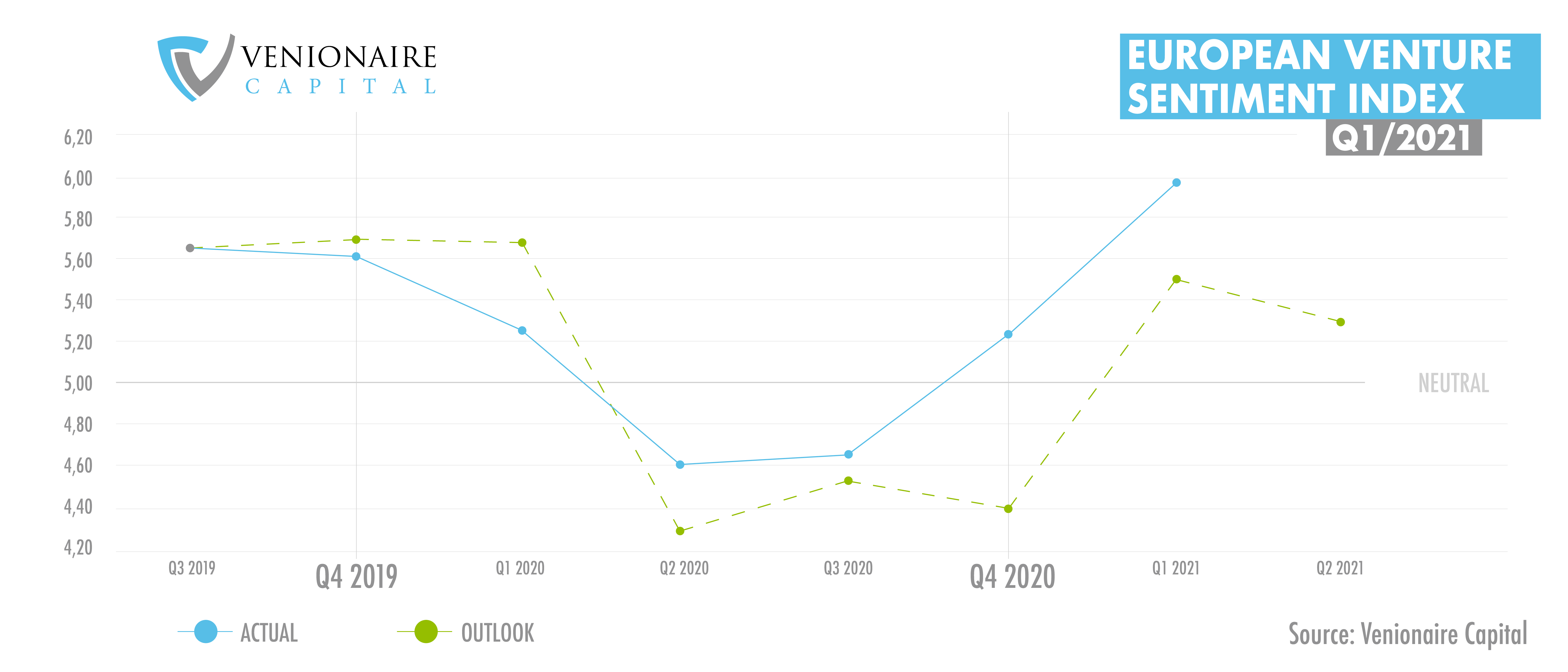

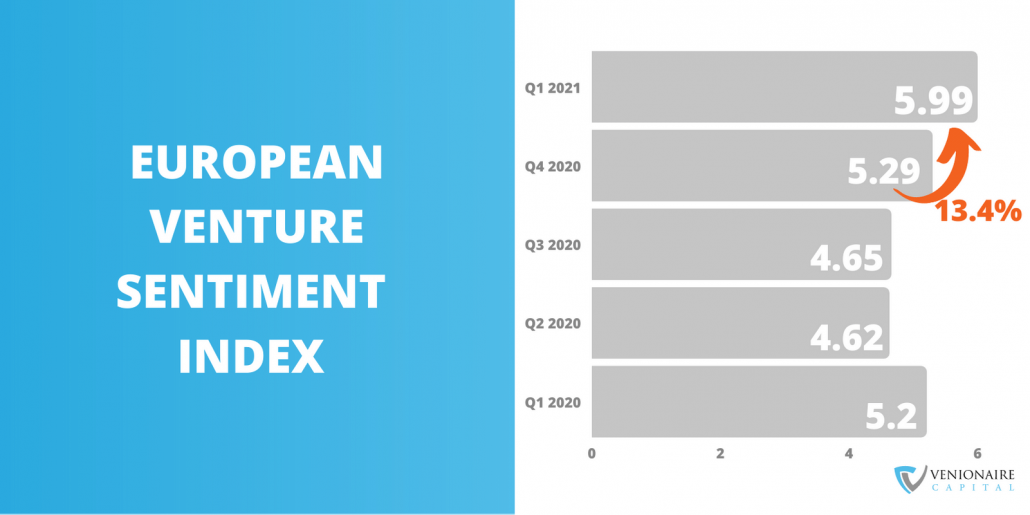

Investor sentiment has become inseparable from what’s happening on the COVID-19 vaccination front. With mostly good news in that department during Q1 (particularly in the United States, Israel and the United Kingdom), the latest index took a record quarterly jump. From 5.29 in Q4, it leapt 13.4% to 5.99 in Q1.

Source: European Venture Sentiment Index Reports by Venionaire Capital

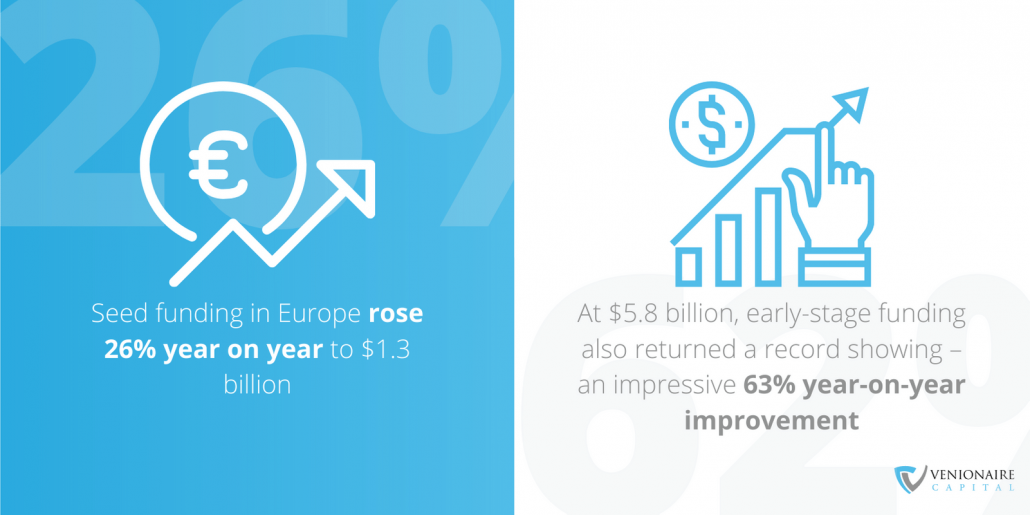

The expected increase in investor optimism was also reflected by an all-time high in quarterly venture investment transaction volumes. Seed funding in Europe rose 26% year-on-year to $1.3 billion. At $5.8 billion, early-stage funding also returned a record showing – an impressive 63% year-on-year improvement.

Source: Crunchbase

But nothing could match the explosion in late-stage and technology-growth funding, which came in at $14.3 billion: a staggering 202% year-on-year increase.

As the index summary points out, all this has a lot to do with the fact that vaccination is beginning to work. Investors are noting with satisfaction that countries with a high proportion of the population vaccinated have since February begun to experience a substantial decrease in active cases.

Source: Crunchbase

Among the trends noted in the quarter were strong VC interest in cryptocurrency and blockchain technology. British company Blockchain.com raised a $350 million Series C round in late March, whilst Austria’s Bitpanda landed a Series B of $170 million.

This is no surprise given the pandemic’s role in accelerating global digitalization and general appetite for new concepts in every facet of life. But it’s also down to the blockchain infrastructure having reached a certain level of maturity and the emergence of many credible companies that have come together to form an ecosystem.

Venture capital investment in the remainder of 2021

Just as was the case at the end of Q4 2020, the outlook remains positive for the second quarter of 2021. It should be noted, however, that there are indications of a slight cooling in investor optimism. As noted in this article, investors can be sceptical about what might look like a bubble set to burst, and increasing numbers are beginning to feel startups are becoming overpriced.

Another reason investors may be taking more of a wait-and-see approach in the next quarter is that we are moving from an uncertain time, where opportunities simply had to be grabbed, into the concrete consequences of widespread vaccination. Many will feel that the moment to ‘be bold while others fear’ has now gone, and the time to wait for a post-pandemic world to take shape has come.

So, with many having made big moves during the first quarter of 2021, a lot of investors have publicly said that the next few months will be about consolidation and setting their portfolio companies on the road to success.

That will mean tapping into their own networks, experience and mentoring resources.

With regards to the crypto space in particular, some experts predict a bear market coming around September.

None of this means that the investment train will stop, just that a lot of VC’s may get stricter on their fundamentals and limit risky plays. They have, after all, spent a lot of money in the first part of the year!

Investors with a global overview will still be keeping a watchful eye on countries where vaccines have been slow to get going. Trends in places where inoculations are already advanced may give an indicator of upcoming opportunities in those markets that are lagging behind from a pandemic recovery perspective.

“Europe is far away from unity. Local sentiments are extremely different. The overall improvement in investor confidence compared to the previous quarter, might be misleading in this regard and investors need to be conscious. Deal sizes increased, valuations increased, as competition for the best deals is higher than ever. On the flip side, many startups outside of Berlin and London face hard times when raising funds for a Series A,”

– comments Berthold Baurek-Karlic, the founder and CEO of Venionaire Capital.

The Conclusion

None of this means that the investment train will stop, just that a lot of VC’s may get stricter on their fundamentals and limit risky plays. They have, after all, spent a lot of money in the first part of the year!

Investors with a global overview will still be keeping a watchful eye on countries where vaccines have been slow to get going. Trends in places where inoculations are already advanced may give an indicator of upcoming opportunities in those markets that are lagging behind from a pandemic recovery perspective.