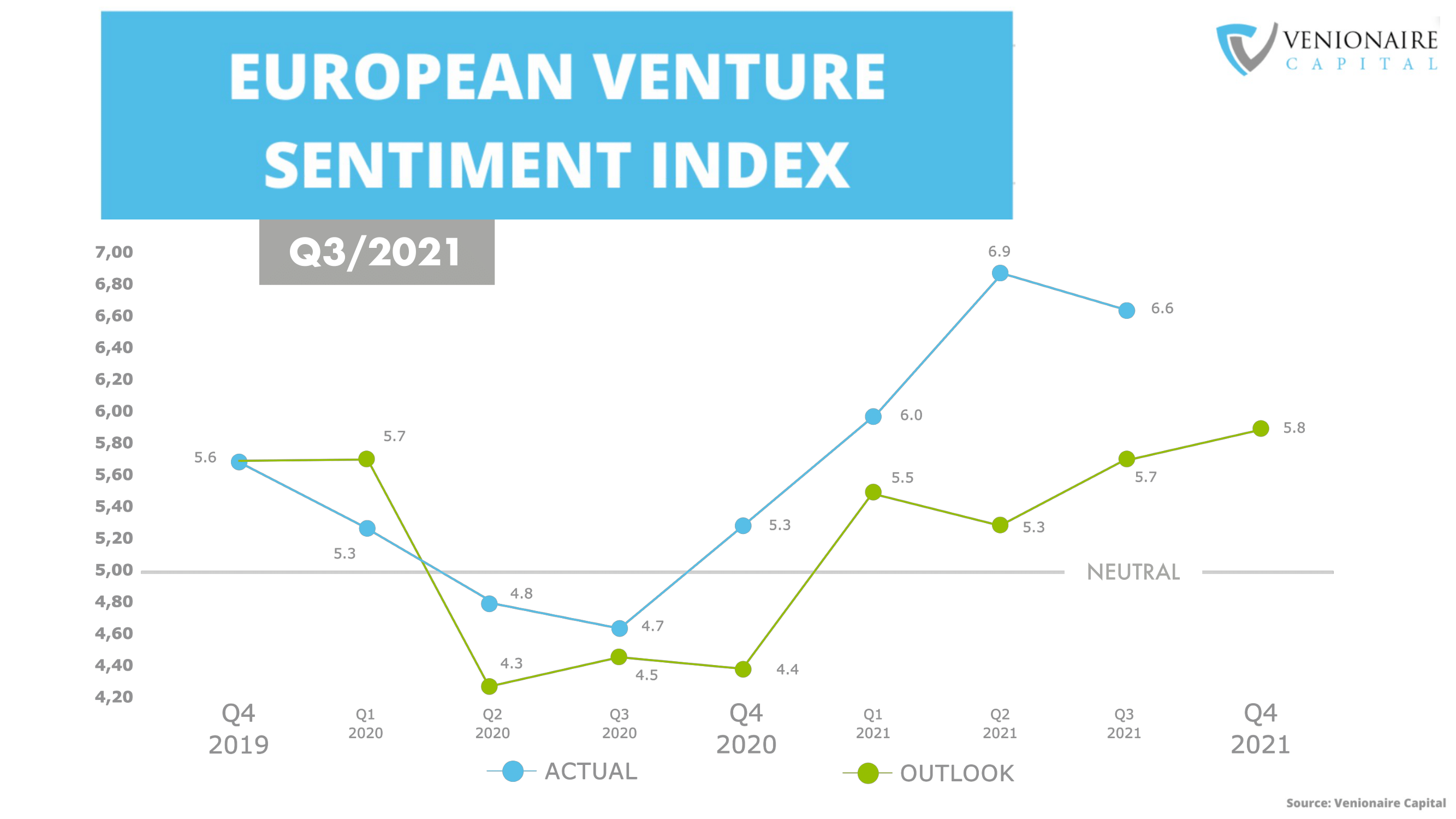

THE VENTURE SENTIMENT CONTINUES TO BE IN POSITIVE TERRITORY IN Q3 2021

The quarterly survey published by Venionaire Capital shows that the market performs strong, however, there is a quarterly drop in investment volume across Europe. The outlook for the next quarter is less optimistic than the observed actual.

Overview

Western economies are showing signs of recovery from the pandemic. Concerns related to mutation variants have decreased, as vaccination efforts prove to be relatively effective. The European “Economic Sentiment Indicator” (ESI) remained high throughout Q3 (Eurostat, 2021). However, a new global wave of concerns in the form of international supply chain bottlenecks has materialized. The current supply gap in some sectors has resulted in significantly higher energy and import/export costs.

“Optimistic market sentiment seems to fade. On the one hand we see large transactions, and a rising number of European unicorns throughout the European Union. On the other hand, early-stage transactions become more difficult, as individual angel investors can’t lift the sizeable seed rounds alone. Investment Networks and syndicates – such as European Super Angels Club – move into earlier rounds and replace individual investors. Having noticed this, current developments lead to inflated valuations, tighter terms and conditions and a higher ratio of declined investments – while more and more newly founded companies are entering the market. European and national policy for early-stage markets will need to tackle these effects, as innovation dynamics and top tier talent demand fruitful soil to develop in Europe.”

– Berthold Baurek-Karlic, CEO and founder Venionaire Capital.

The venture sentiment actual decreased compared to Q2 but remains in positive territory. The outlook for Q4 increased over the anticipated outlook for Q3 but is still less optimistic than the observed actual. The trend of high investment activity and higher valuations of ventures continues and we see more emerging unicorns across several industries and geographical locations. On an yearly basis the market is performing strong, however we see a quarterly drop in investment volume across Europe. The UK continued to grow while other big ecosystems shrank which might come as a shock especially post Brexit.

Other topics covered in the latest report:

- First drop in the sentiment actual since Q3 2020

- Closing the gap between sentiment and outlook

- Fintech continues to be on the rise while delivery startups engage in fierce competition wars