MACROECONOMIC STRUGGLES SUPPRESS EUROPEAN VC.

European venture capital continues to decline due to overall negative macroeconomic events, since the first quarter of 2022.

The unpredictability and the unexpected extension in the duration of the war between Russia and Ukraine is the main cause of high inflation, energy shortage, and supply chain bottlenecks (European Council, 2022). The opinions of economists and central banks on recession have strongly shifted in Q3.

SENTIMENT DECREASES FOR A THIRD QUARTER IN A ROW.

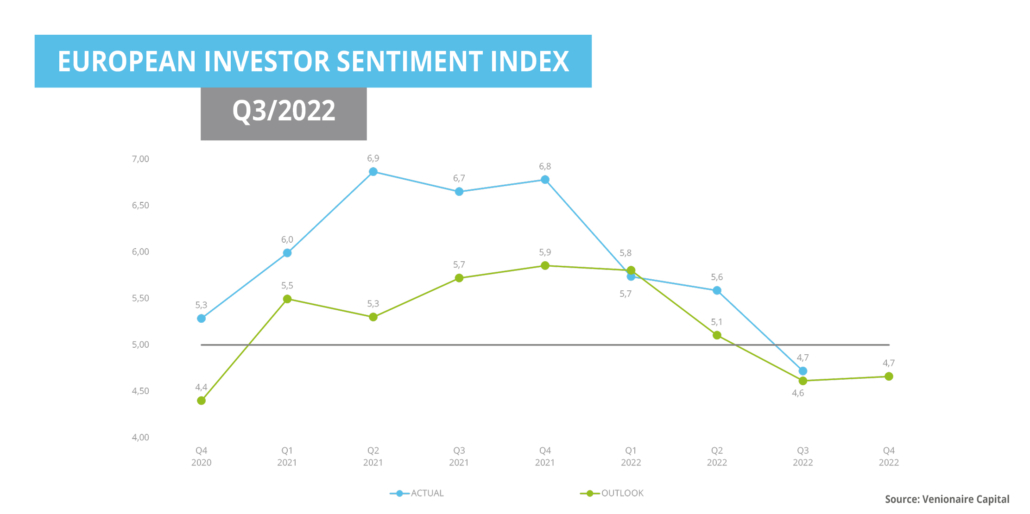

In Q3 2022, we recorded another decrease in the index actual continuing the trend from Q1 and Q2. The index dropped from 5.6 in Q2 to 4.7 in Q3 entering negative grounds. This represents a 15.5% decrease on a QoQ basis as well as a 29.1% decrease on a YoY basis.

So far, this quarter is the second lowest recorded actual since the launching of the index

The only lower value recorded for the index actual was in Q3 2020 when the index actual was measured at 4.65. Back then, the COVID-19 pandemic raised investors’ concerns with regard to healthcare (development of vaccines), global economic slowdown (lockdowns) and supply chain shortages (international

trade closing down). Similarly, the outlook for Q4 2022 (4.66) is very close to the outlook for Q4 2020 (4.40).

Topics covered in the latest report:

- MACROECONOMIC STRUGGLES SUPPRESS EUROPEAN VC

- SLOWDOWN IN EUROPEAN VC ACTIVITY

- THE UK LEADS IN VC ACTIVITY AMID HEAVY ECONOMIC AND POLITICAL CRISIS