AI capex Reality Check: When Scale Meets Capital Discipline

This article offers a focused insight into one of the core mechanisms shaping markets in 2026. The full Market Outlook 2026 provides the broader, integrated context across macro, public markets, private capital and digital assets.

The 2026 equity narrative is not simply “AI wins” or “AI fades”.

It is a more specific tension: the same companies that dominate AI leadership are also absorbing an exceptional share of the system’s capital. In a higher term-premium world, that makes the cost of leadership a first-order valuation variable.

Concentration is not a footnote – it is the starting point

AI-centric mega-cap technology leaders remain the centre of gravity for index weight and earnings delivery, supported by exceptional levels of AI infrastructure spending.

The concentration is quantified: the “Magnificent Seven” accounted for 34 to 35% of the S&P 500 market cap in 2025, up materially from 2024.

That is the backdrop for 2026 selection. When leadership is narrow, mistakes are amplified – and “being right on the theme” is not the same as “being right on the price”.

CAPEX is the new filter – because the scale is historically exceptional

Estimates put hyperscaler spending at around $400bn in 2025 (roughly +70% YoY), and forecasts show it exceeding $500bn in 2026 as data centre and compute buildouts accelerate.

Major Big Tech issuers increasingly use debt to finance part of this cycle. In 2025, they raised >$120bn in new debt to support AI and cloud infrastructure. That signals how capital-intensive the buildout has become.

The risk is not that investment is “too big” in absolute terms. The risk is the mismatch between the pace of capital deployment and the pace of near-term earnings delivery, particularly if revenue realisation is back-loaded.

The phase shift: scale is no longer sufficient

A clear regime statement sits at the top level of the outlook: the AI investment cycle is entering its next phase. Markets increasingly demand capital discipline, monetisation evidence, and capex efficiency – not just scale.

That shift matters because the outlook frames 2026 as a year with less room for error. Markets punish valuation stretch and narrative excess faster; dispersion rises; leadership becomes more selective.

What “capital discipline” means in a capex-heavy cycle

In this setup, the difference between “structural winner” and “overpriced infrastructure builder” becomes decisive. Heavy investment can create extraordinary capability – and still produce mixed returns for the companies funding the buildout, especially when capex growth outpaces near-term earnings delivery.

A disciplined lens is therefore practical, not philosophical. It turns into questions such as:

- Does the capex trajectory match visible earnings delivery, or does revenue realisation become increasingly back-loaded?

- Does the buildout rely more on debt financing – and does that change the market’s tolerance for valuation?

- Are expectations already demanding, or is valuation support still present?

Where the “capex reality” creates relative opportunity

In a higher term-premium world, valuation asymmetry matters more. With U.S. market concentration near historic highs and valuations stretched, relative opportunities broaden toward lower-valuation markets and sectors where expectations are less demanding.

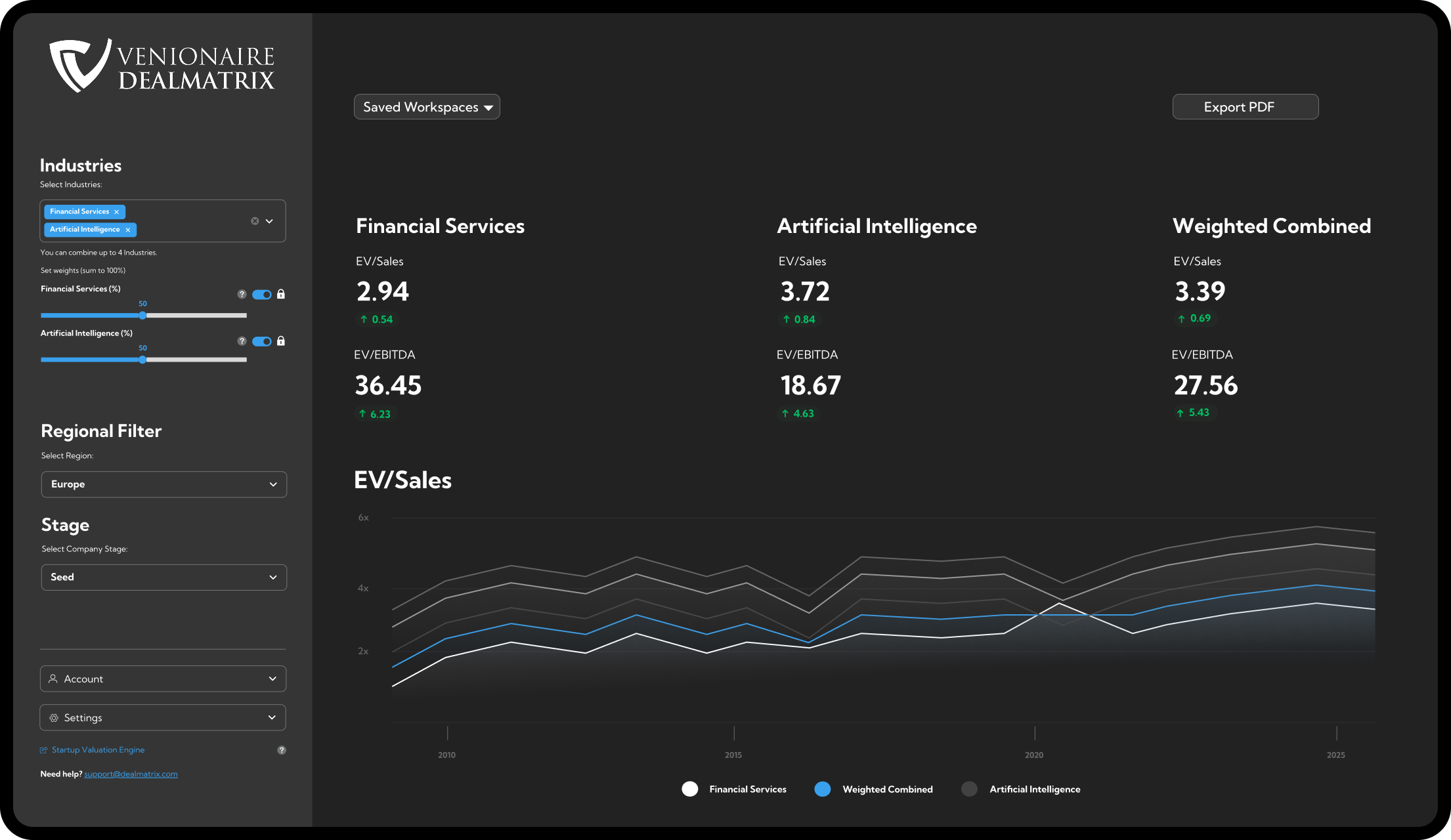

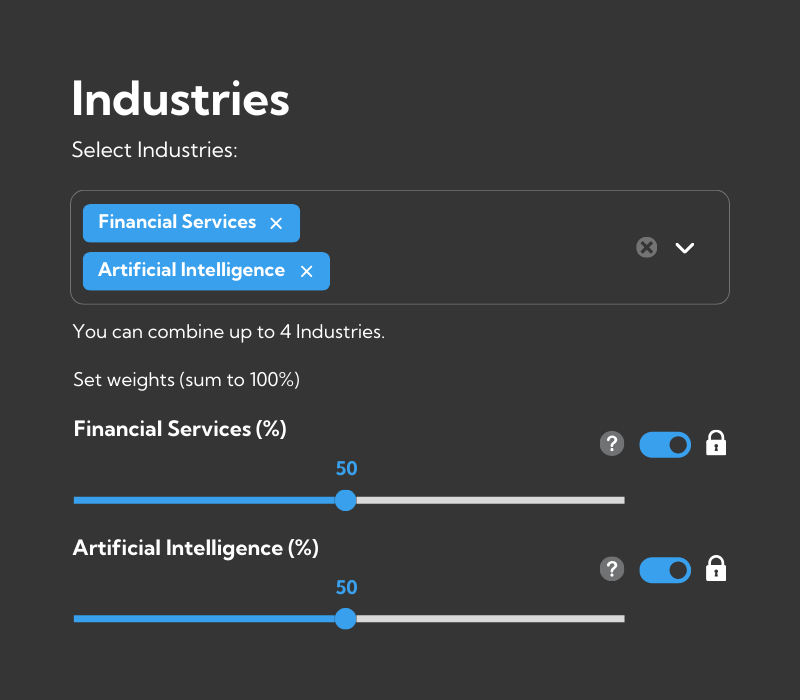

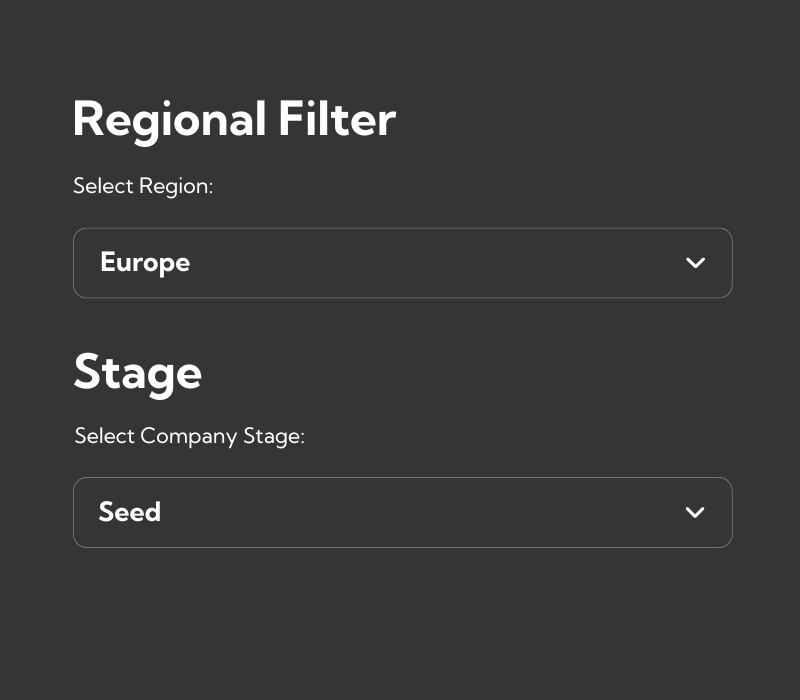

This is where the selective case for Europe enters: European-listed tech equities can benefit from a valuation rotation as investors seek alternatives to stretched U.S. mega-caps.

As of late 2025, European equities traded at approximately ~15x forward earnings compared to ~22–23x for the S&P 500, implying a ~30–35% valuation discount, well above long-term historical norms.

The point is not “Europe replaces the U.S.” The point is that valuation support and dispersion create room for selective rotation – particularly toward quality earnings, balance-sheet strength, and sectors where expectations are less demanding.

Bottom line

AI remains the leadership engine – but leadership now comes with a measurable capital bill. In 2026, the question is not whether the buildout continues; it is whether the market pays for the buildout at the same multiple once it assesses capex intensity, financing mix, and earnings delivery under a higher hurdle rate.

If you want the integrated view – how AI concentration and capex reality connect to the discount-rate regime, cross-asset dispersion, and regional valuation rotation – the full Market Outlook 2026 connects those dots.