Decision Making in the Venture Industry

René Andres under the supervision of Prof. Jörn Block from the University of Trier conducted a comprehensive study on decision making of growth venture investors. They did a “conjoint-experiment” with 798 investors, in which each participant was asked to make a series of decisions between several growth ventures that were presented to her/him. Their survey brought up some interesting facts on what is important for investors.

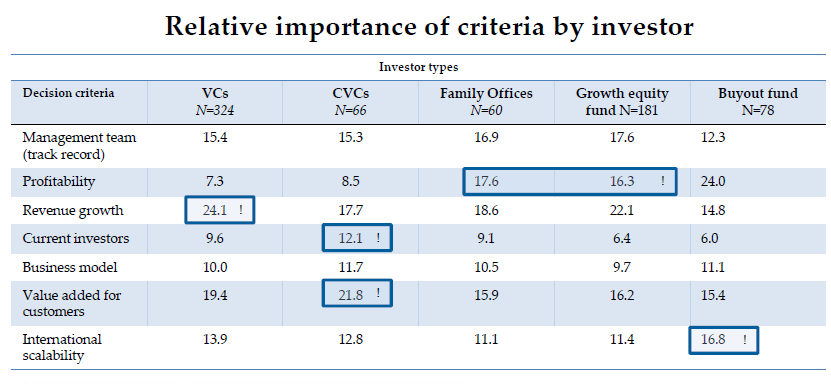

Revenue growth has the highest relevance

It turned out, that revenue growth is the most important criteria for investors, followed by the value-added of the product or service for costumers. The third most important criteria is the relevant track record of the management.

Investors also showed a clear preference for business models with a lock-in design which makes it difficult for customers to switch to another provider (e.g. marketplaces).

Later Stage Investors focus on Profitability

Mr. Andres and Mr. Block further analyzed the importance of the mentioned criteria by investor type. For Venture Capitals (VCs), the most important criteria is the revenue growth of the venture, whereas for Corporate Venture Capitals (CVCs) it is the value-added of the product or service for the customer. CVCs put the highest importance to the criteria of current investors. For VCs as well as CVCs the profitability was the least important criteria in contrary to buyout funds, growth equity funds, and family offices. Interestingly, growth equity investors seem to put more importance on the track record of the team than VCs.

Majority of Funds have an IRR of 11-30%

The researchers also asked respondents about the average IRR of their fund, resulting in the graph below.

One rather consistent pattern they found was that investors with entrepreneurial background were associated with higher financial performance. We were happy to support this study as a participant.

Venionaire supported this study as one of the 798 participants.

You can download a comprehensive research report here.