EVSI

European Venture Sentiment Index

In a europe-wide, quarterly survey, we assess the current sentiment of venture capital investors and business angels, as well as their current outlook for the coming quarter. Unregulated private investors (such as family offices, high-net-worth individuals, and top-managers), as well as regulated (institutional) investors have a strong impact on the speed of development and disruptiveness of European innovation.

Read and be part of the

European Venture Sentiment Index Reports

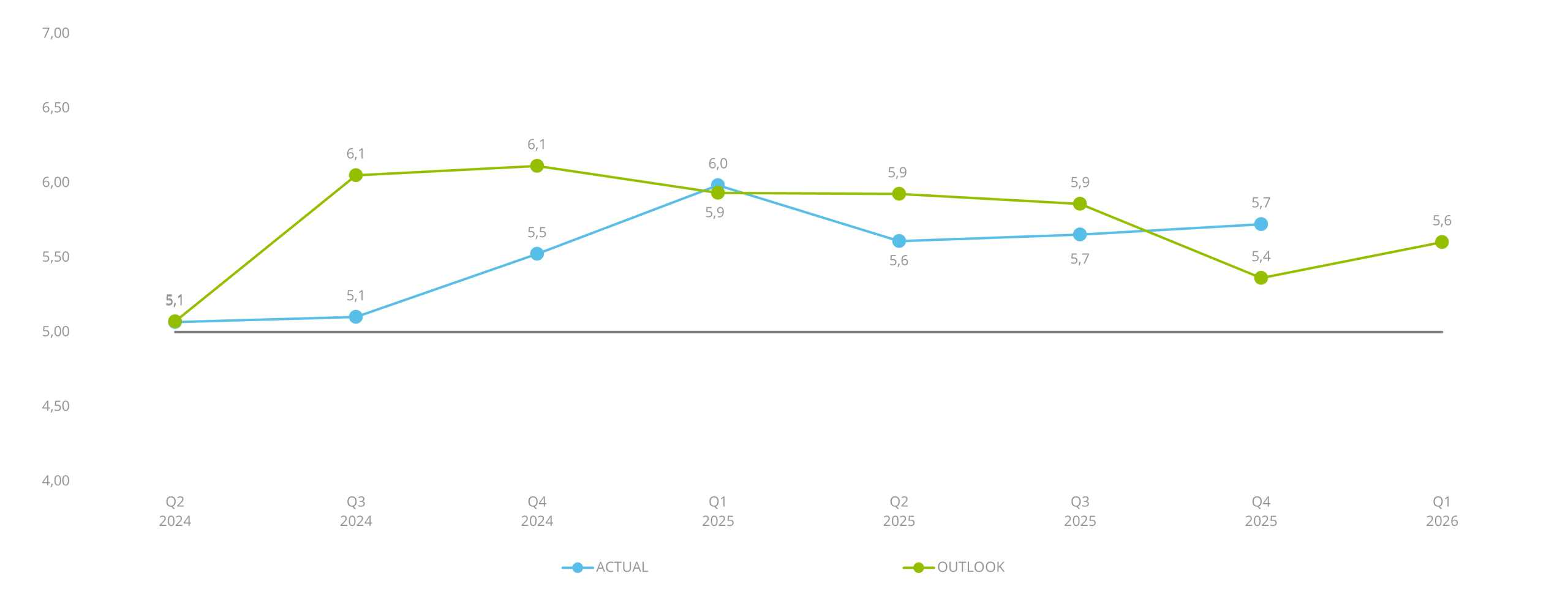

In Q4 2025, the index actual stood at 5.7, exceeding the 5.4 of the projection. The figure reflects the improvement from Q3 (QoQ +1.2%; YoY +3.6%). However, beating expectations in Q4 2025 suggests sentiment is recovering faster than projected and that investor confidence is building again. Overall, it narrows the expectations gap and supports a more constructive start to 2026. The composition of the index actual in Q4 2025 in general showed a broadly positive picture.

The current startup valuations increased by 3.9%, deal flow quality improved by 8.6%, competition for deals rose by 14.6%, and the fundraising environment strengthened sharply by 42.5%. The only negative trend was noticed in the investor activity, which declined by 18.4%, indicating that despite improving confidence and funding availability, investors remain selective in deploying capital as the market moves into 2026. This shift is clearly reflected in the index movement. In Q4 2025, the index exceeded its prior projection, indicating that confidence improved faster than expected, while measured investor activity continued to decline.

This divergence underscores a structural change in behaviour: improving sentiment is no longer accompanied by broader risk- taking, but by more targeted capital allocation. Investors are moving from pure risk management toward selective conviction, concentrating capital in fewer opportunities that combine operational efficiency, strategic relevance and credible scaling paths. The EVSI thus points to a market becoming more constructive yet remaining firmly selective as it enters 2026.