Venionaire DealMatrix Multiples: Valuation Built for Private Markets

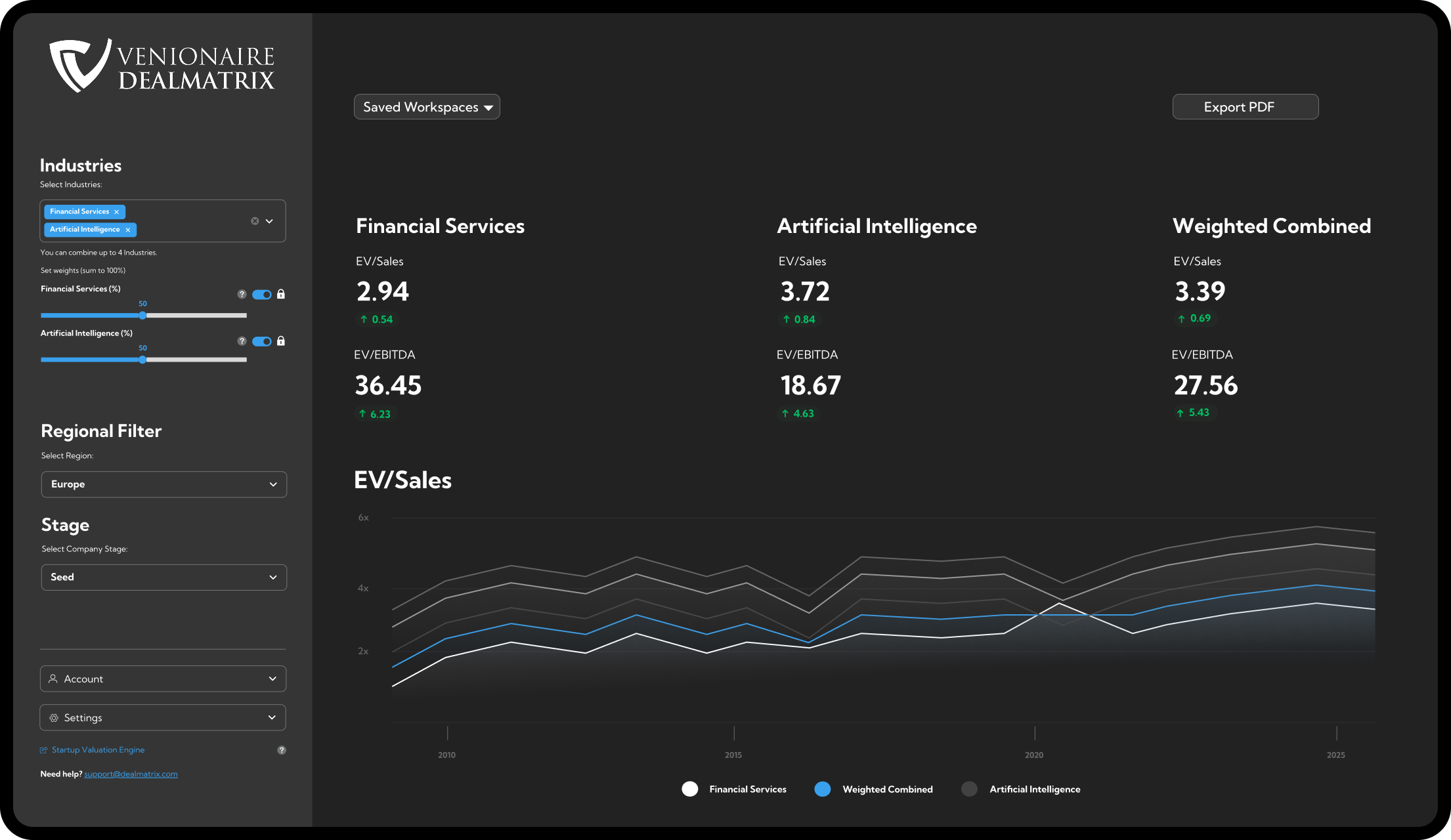

Venionaire DealMatrix, subsidiary of Venionaire Capital, has launched Venionaire DealMatrix Multiples, providing private-market EV/Sales and EV/EBITDA valuation multiples that can be explored by sector, stage, and region.

Figure 1: Venionaire DealMatrix Multiples

The launch builds on Venionaire Capital’s long-standing activity across Venture Capital, Private Equity, and M&A, where valuation decisions are routinely made in environments characterized by limited transparency and high contextual dependency.

The challenge: valuation without a private-market framework

Across private markets, pricing decisions are still largely anchored in experience, precedent transactions, and public-market multiples. Not because these tools are ideal, but because there has been no widely available alternative designed specifically for private companies.

Private transactions are rarely disclosed, deal terms are negotiated bilaterally, and pricing varies significantly by sector, company stage, and geographic context. As a result, comparability is limited and valuation discussions often rely on narrative rather than a shared analytical foundation.

Why public-market multiples fall short

Public-market multiples became the default reference due to their availability and structure. However, they reflect a fundamentally different environment—one shaped by liquidity, scale, standardized reporting, and immediate exitability.

These characteristics rarely apply to private companies. Applying public multiples to private transactions therefore requires subjective adjustment, which introduces inconsistency when used systematically across deals.

Building a private-market methodology

Venionaire DealMatrix Multiples were developed to address this structural gap.

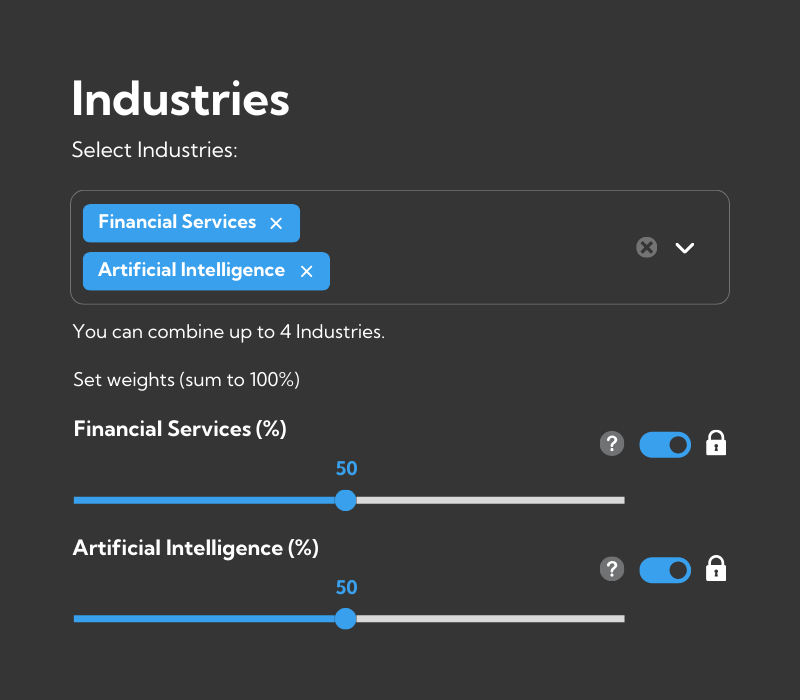

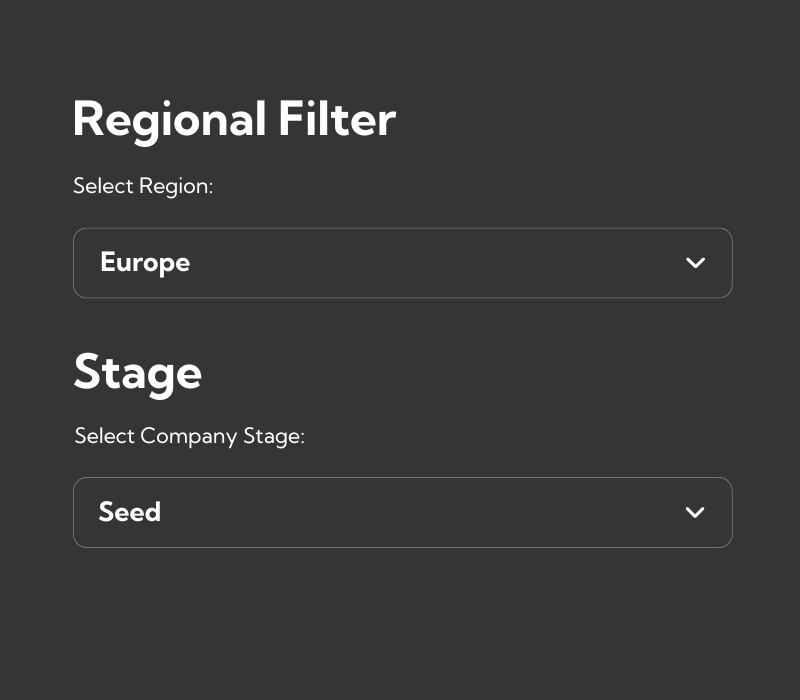

Instead of adapting public-market benchmarks, the methodology was built from the ground up around private-market characteristics. The result is a framework for calculating EV/Sales and EV/EBITDA multiples for private companies, structured by:

-

sector

-

company stage

-

geographic region

Figure 2: Industries Filter

Figure 3: Regional & Stage Filter

Public-market data serves as a starting point for peer-group identification, but is systematically contextualized using macroeconomic indicators and proprietary private-market datasets accumulated through Venionaire’s work in Venture Capital, Private Equity, and M&A.

Launching Venionaire DealMatrix Multiples

Venionaire DealMatrix Multiples are now live. They are designed to support valuation discussions, deal screening, and comparative analysis by providing structure where private markets have traditionally relied on fragmented benchmarks and individual experience.

To introduce the product, the DealMatrix team has prepared a short video demonstrating how the platform works and how private-market multiples can be explored in practice.