As we enter 2025, the venture capital (VC) landscape is poised for growth. After a challenging period, the VC market is showing signs of recovery, with increasing deployment and an emphasis on high-quality startups. This article explores the key trends and opportunities in venture capital for 2025.

2024: A Year of Recovery

In 2024, venture capital deployment grew by 20% year-over-year, driven by strong private equity returns, the end of cash runways set in 2022, and the maturation of high-quality startups. These elements have created a favorable environment for VC investment, signaling that the market is ready to accelerate. A thorough analysis of 2024 and its implications is available in the latest European Venture Sentiment Index (EVSI) Report, which our Analyst Team conducts quarterly.

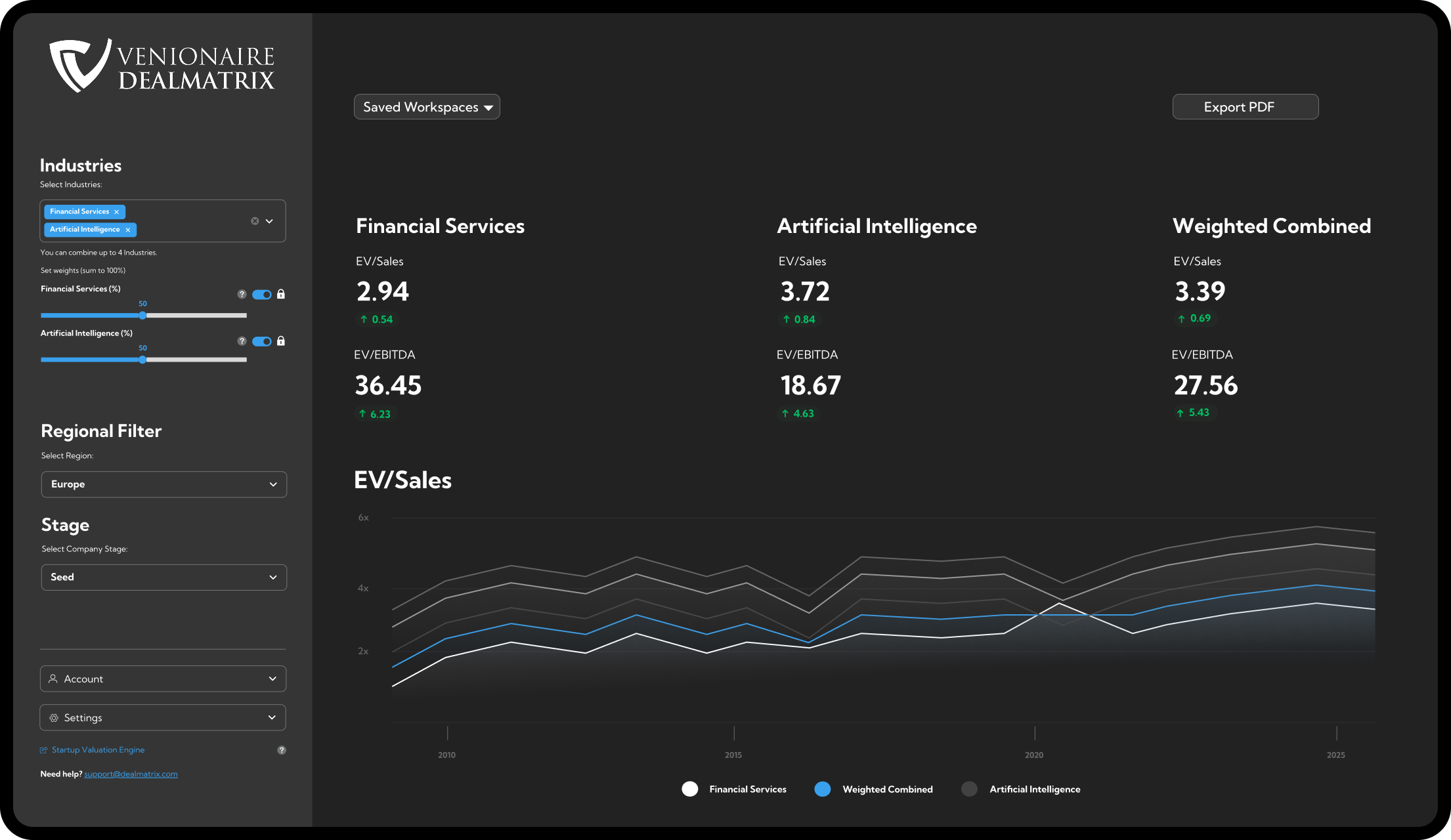

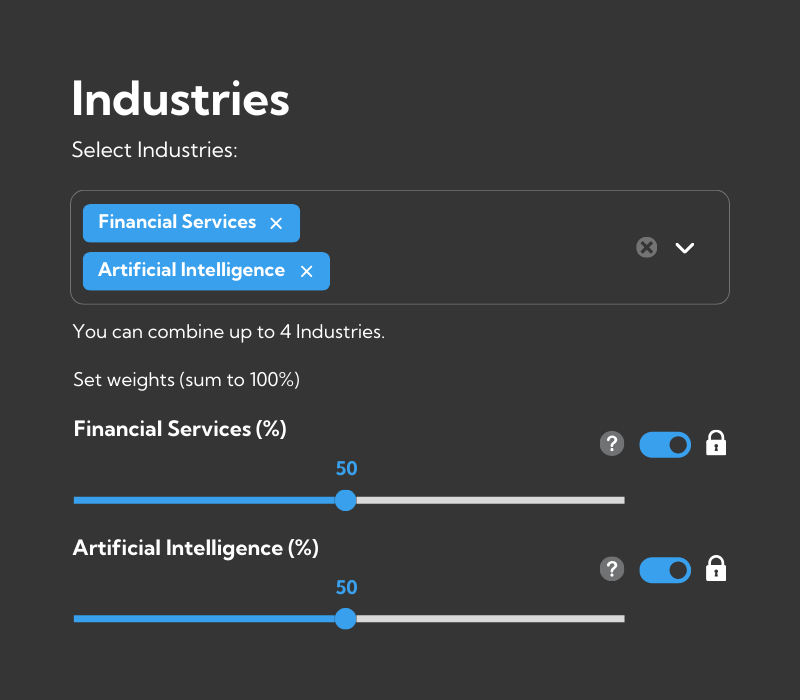

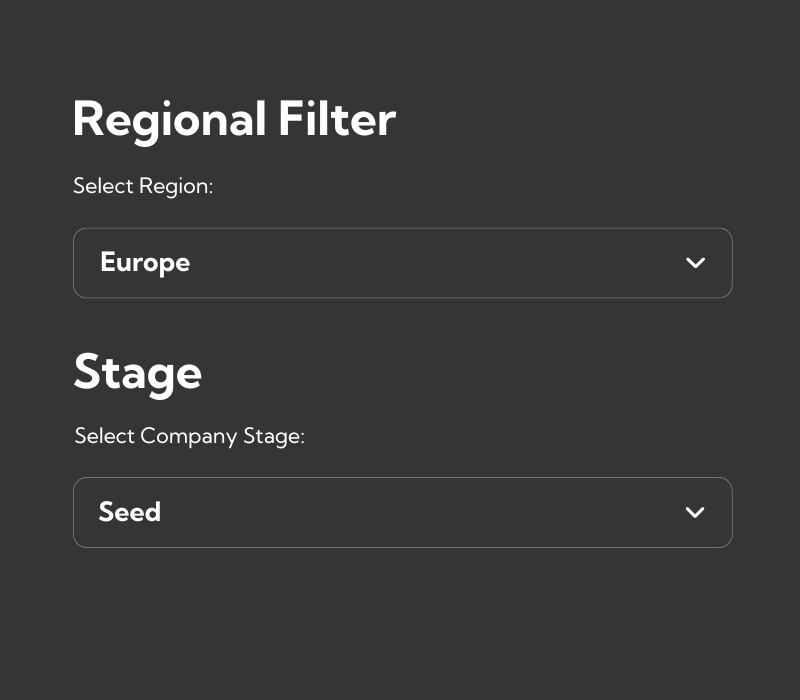

Rising Valuations

Valuations in venture capital are continuing to climb, especially in the U.S., where AI-driven companies are leading the way. The dominance of artificial intelligence (AI) means that top-tier startups are commanding premium valuations. While this presents opportunities for investors, it also brings challenges, as higher valuations require careful evaluation to avoid overpaying for potential investments.

The IPO Resurgence

A key development for VC in 2025 is the expected resurgence of IPOs. After a dip in recent years, the U.S. IPO market is projected to bounce back, with PE-backed IPOs leading the way. Additionally, in a favorable scenario, as many as 20 unicorns—companies valued at over $1 billion—could go public, with a total valuation exceeding $117.5 billion. This offers VC investors the potential for significant liquidity events.

Europe is also seeing a healthy pipeline of IPOs, which provides more exit opportunities for VC-backed companies. The return of IPOs could be a crucial strategy for VC firms to achieve substantial returns.

Emerging Sectors: Key Areas for Investment

As we look toward 2025, several sectors stand out for their growth potential. These industries are drawing substantial VC interest and are expected to see significant innovation.

AI: Transforming Industries

AI remains a dominant force in venture capital, reshaping industries such as healthcare, finance, and energy. In 2024, one-third of global VC dollars were invested in AI startups, showcasing the sector’s growing importance. In 2025, new AI technologies, particularly agent-based applications and generative AI, will unlock new opportunities, offering advanced solutions to complex problems in areas like law, medicine, and software development. The declining need for capital, as seen with Deepseek, will play a crucial role in 2025. As a result, AI model development becomes increasingly cost-effective. Companies like Q.ANT, a leading developer of photonic AI chips, are revolutionizing energy efficiency and reducing capital requirements in the AI sector.

For VC investors, focusing on companies that prioritize outcome-driven solutions over traditional software models will be key to capturing long-term growth.

Life Sciences: A Hotbed for Innovation

The life sciences sector is expected to see significant growth in 2025, driven by breakthroughs in biotechnology, genomics, and drug discovery. Moreover, AI is playing a critical role in accelerating drug development and improving healthcare outcomes. As more life sciences companies adopt AI technologies for drug discovery and diagnosis, the sector presents lucrative opportunities for VC investment.

The convergence of AI and life sciences could lead to faster innovation and improved therapies, making this a vital area for venture capital firms to explore.

Renewable Energy: The Future of Sustainability

Renewable energy is a key focus for VC investment in 2025. With global clean energy goals, particularly in India and the EU, sectors like solar, wind, and geothermal are seeing increased funding. Geothermal energy is especially exciting due to its potential for reliable, scalable energy production. Circular economy is also a promising sector for 2025. Therefore, we at Venionaire are particularly excited about the EU InvestCEC project. We are responsible for setting up a circular economy alternative investment fund. InvestCEC will develop a replicable model for the initiation of circular economy projects in cities and regions, that will improve collaboration between entrepreneurs, investors and policy makers. The project will be tested in pilot city Klagenfurt am Wörthersee.

Additionally, energy storage technologies, such as battery innovations, are growing rapidly, with increased interest in clean hydrogen and sustainable aviation fuels. These sectors align with global sustainability goals and offer substantial opportunities for venture capital.

Global VC Landscape: Emerging Markets

Geographically, venture capital is expanding into emerging markets, particularly in Asia-Pacific. India is quickly becoming a major hub for VC, thanks to its growing middle class and thriving tech ecosystem. The country offers strong opportunities for startups in AI, fintech, and other high-growth sectors.

In Europe, middle-market VC deals are on the rise, particularly in the EUR 100 million to EUR 5 billion range. This segment remains a core part of European venture capital, attracting increasing investor interest.

A Dynamic Market Ahead

Venture capital in 2025 is set for an exciting year, driven by rising valuations, a resurgence in IPO activity, and a strong focus on high-growth sectors like AI, life sciences, and renewable energy. While opportunities abound, VC firms will need to carefully navigate the landscape, balancing innovation and geographical diversification with prudent investment strategies.

With an eye on these emerging trends and sectors, venture capital firms are well-positioned to thrive in 2025 and beyond.

Listen to all the new trends and market developments in the first episode of Venionaire Insights: