Corporate Startup Engagement (CSE) is certainly a trend. We found out that more than half of all corporates in the Austrian Traded Index (ATX) are already collaborating in some form with startups (see Venionaire Survey on Corporate Startup Engagement, 2017). We see many new startup challenges emerging in all kinds of industries, calling for promising ideas, services or products. The goal is always to attract the best startups with a specific profile. The awards are ranging from simple publicity over close collaboration to direct investments. However, the underlying objectives of corporates are very different and should be taken into account when implementing a CSE strategy.

In this rather comprehensive article, we want to share our experience on how to find the right startup engagement models, which do fit your corporate objectives and match with available resources. This is based on our theoretical models as well as our practical experience as co-founders of “Innovation to Company”, which is Europe’s biggest Startup Challenge, helping startups to accelerate their business. Once a specific CSE program (note: most corporates use more than one channel to strategically interact with startups) has been selected and is about to become implemented, it’s important to design an offer which is likely to attract the right amount and quality of startups to work with.

Index

- Values Matter

- Define Clear Objectives

- Holistic Landscape of Corporate Venturing

- Types of Startup Engagement Programs

- Starting an Accelerator Program

- Example: The Startup Challenge “Innovation to Company”

- Conclusion

Values Matter

The most successful startup programs in Europe have a clear set of principles. We believe at least five key values should be applied to every startup program:

- Think ‘Founders First’ – It’s very important to understand founders needs and foster their international development, instead of soaking them up as a strategic corporate.

- Be transparent – Put all cards on the table, make motivations and goals of the corporate completely transparent.

- Have a coaching mentality – Facilitate business relations and be open to learn every day.

- Results matter – Efforts are nice, but what matters is a true business outcome.

- Keep things fun – Take your work seriously, but be not afraid to have fun and encourage founders to be themselves.

Define Clear Objectives

Objectives behind startup challenges and any other startup program (e.g. open innovation, partnerships, preferred offerings, etc.), incubators, accelerators or corporate venture funds are very different. However, we wouldn’t recommend corporates to start such a program just for the sake of a good public image. Young entrepreneurs are normally well connected and word of mouth will run fast among them. In our daily work with corporates, we spent a lot of effort to carve out the motives and goals for launching a startup program. This is necessary, as the objectives are determining how and what kind of program is the best fitting one as we are going to explain below.

Holistic Landscape of Corporate Venturing

Every Corporate Startup Engagement initiative starts with its goals. In general, there are 4 major arguments for corporate startup engagement:

- Better access to new, innovative ideas

- Possibilities for testing new products

- Lowering the costs of innovation

- Reducing the risk of innovation

We usually start with the big picture of a holistic CSE landscape and challenge our clients which approaches they already have in place or where they have had specific learnings in the past. The graphic above illustrates the arguments for corporate startup engagement combined with the possible directions of single solutions. However, as they closely play together, most of the time it is hard to argue that a standalone solution will deliver all needs for all business units and strategic goals of the corporate. Therefore, most corporates implement a set of programs in order to cover all aspects. If corporate startup engagement is set up right, most startups will probably move within the holistic CSE landscape (hopping from one program to another). Over time, some programs will fit best at first and others will become more important as the positioning and development of a startup or the underlying market change.

Note:

Agreeing on a valuation is one of the most critical point for a good corporate startup relation. We developed a startup valuation tool to help with that.

[hubspot type=cta portal=5314519 id=bc2a7bcd-bcee-4a08-960b-b43a6cea4bfe]

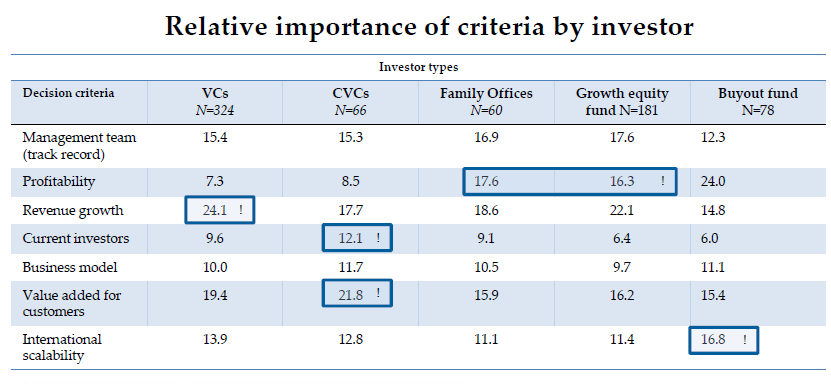

It is important, that corporates examine different startup engagement possibilities in regard to their objectives. The following figure shows how you can cluster specific programs into different strategic approaches for corporate innovation.

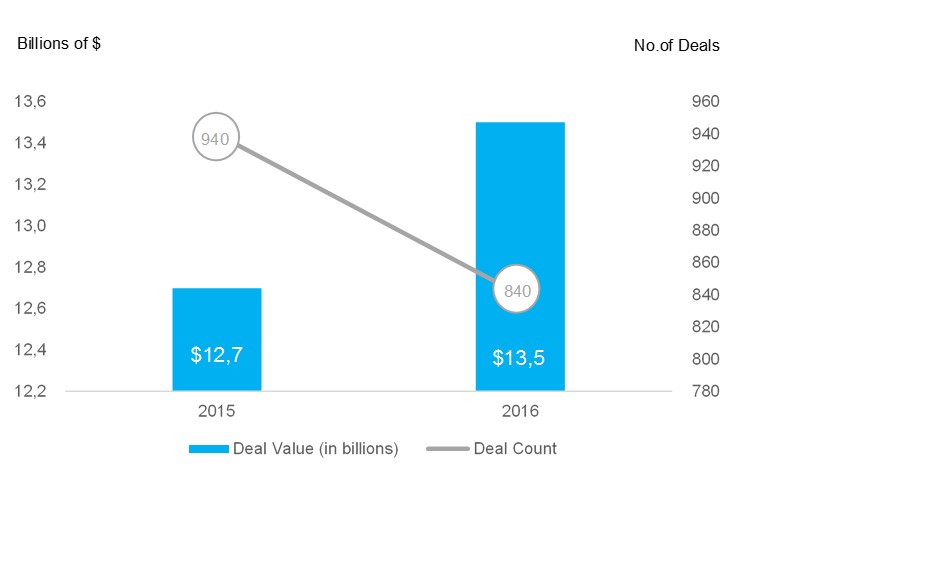

Source: Venionaire Capital based on data from Harvard Business Review, 2002.

If you look at the different corporate startup engagement possibilities from the corporate objectives point of view, you can cluster specific programs into different strategic approaches as shown in Figure 2. You need different solutions, whether a corporation has a stronger emphasis on strategic or financial goals. However, the boundaries among the forms of engagement can be clearly set in theory, but in reality, they will often overlap. As conditions tend to change quickly in the startup world, the holistic approach to corporate startup engagement is a recipe for successful adjustments to the newly established conditions. This framework provides necessary agility for quick and efficient shifts.

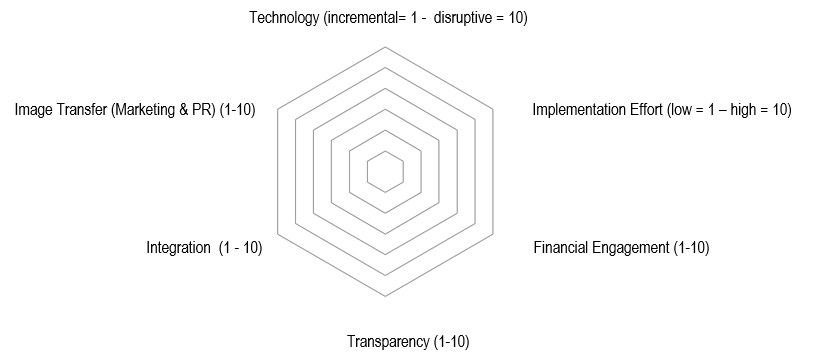

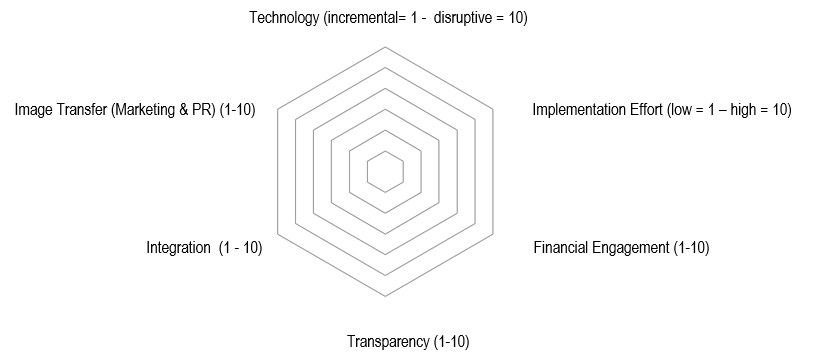

We are always focused on a user-centric development when working with startups and also apply this approach to fine-tune specific solutions within a CSE Framework of a corporate. Venionaire’s CSE-Spider-Function (Figure 3), was developed to define strategic and operational dimensions and available resources.

Source: Venionaire Capital in cooperation with Prof. Matthias Fink (JKU, IFI)

We have identified strategic and operational dimensions which must be understood in relation to each other. The CSE spider function can visualize potential conflicting objectives. An obvious but recurring standard problem could be, that a corporate is not willing to invest enough financial and human resources (implementation effort) to a certain program, which naturally will not enable this program to deliver the strategic goals set by management. Visualizing this conflict enables a more transparent discussion and will eventually help you to get faster to a sound solution.

Strategic Dimensions

- Technology – indicates the level of innovation (incremental vs. disruptive) a corporate is willing to address. This implies also the willingness to take risks and accept failure or write-offs within such a program.

- Transparency – Sets the need for measurability and (usually) quantitative transparency. Research-driven or very early stage-orientated programs have a not so secure outcome than other programs or plain collaborations.

- Image Transfer (Marketing & PR) – Indicates to what extent a program shall strengthen an image of the corporate. However, this holds true for potential reputational risks of a program as well.

Operational Dimensions

- Implementation Effort – the level of involvement in implementing a program (human resources or invested days from specific business units.)

- Financial Engagement – the level of commitment in terms of funding or investment power corresponds with reputational risks and also with chances of positive impacts on the balance sheet.

- The level of integration – shows how deep a program will be integrated within existing business units and therefore gives an indication how much of a strategic control a corporate requires when working with startups. Full control usually means the acquisition, no control usually means non-equity collaboration.

These six dimensions are measured on a 1-10 scale and are depending on their layout, the model indicates which program is the best fitting one for a certain strategy (goal). The possibilities of adjusting the spider function are almost unlimited and it enables customization according to the needs of a user (business unit) or a specific problem, which is supposed to be targeted. The layout of this function visualizes different shapes whether the chosen overall objectives of a program lean more towards financial or strategic objectives.

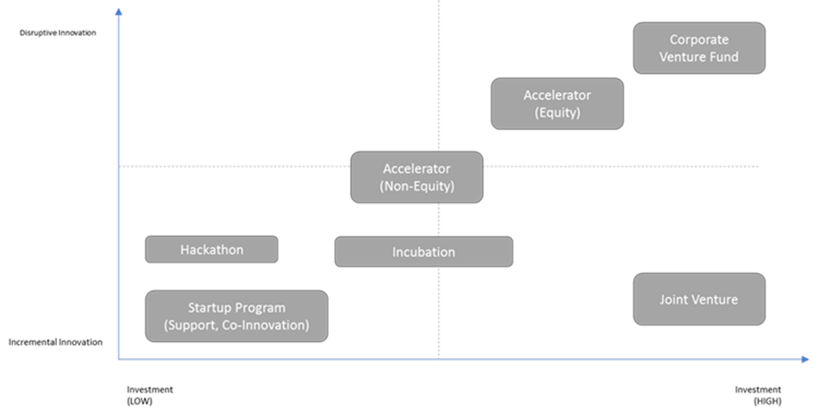

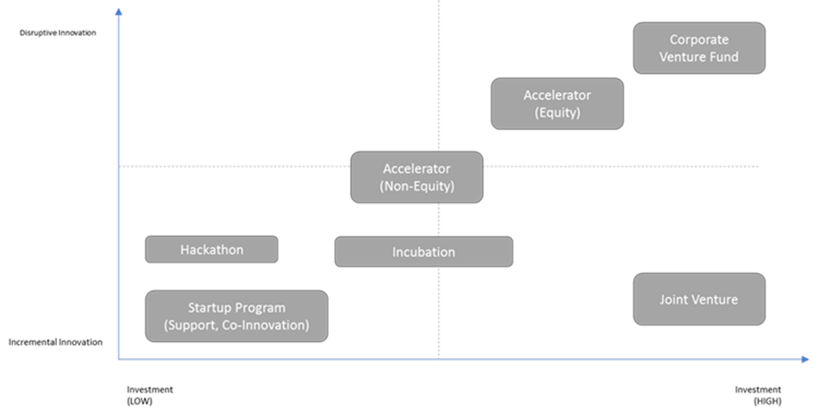

Figure 4 shows possible levels of investment across 7 different CSE programs according to the level of innovation desired (scaling from incremental to disruptive).

Source: Venionaire Capital in cooperation with Prof. Matthias Fink (JKU)

In basic economics, we have learned that “there is no free lunch” and that the ability to take “risks correlates with potential returns and losses”. This basic theory is the foundation of chart Figure 4, which show the correlation between disruptive innovation and the willingness to invest. Low investment approaches will certainly help corporates to understand new technologies and services as well as learn about new approaches to existing problems – fostering a so-called “quick win” or “grassroots effect” among their employees – but it will not favor stronger financials, new market shares or winning against peers. If a corporate sets its yield on this level, it will have to accept the probability of failure among its investments and should most definitely hedge CSE efforts through a holistic approach.

Types of Startup Engagement Programs

Individual programs usually differ in terms of objectives, structure, and timeline. It is crucial to choose the right approach or model that will suit the objectives (goals) of a particular business unit or a number of units within the corporate.

*Generally single – depending on a budget and success may be applied as recurring.

Starting an Accelerator Program

Accelerator programs are a very popular model for corporate startup engagement. However, if you compare “accelerators” around the world, they often have nothing in common except the name. In fact, the term “accelerator” itself does not tell you anything – it’s really about what’s offered and delivered through the program. It is very important for corporates to understand that startups compare programs and make conscious decisions when it comes to applications. Top tier accelerators receive over 800 applications and only accept a handful of startups, therefore being accepted feels like winning a gold medal of entrepreneurship for the founder. To be recognized as a top accelerator, we highly recommend benchmarking startup programs with the following KPIs:

- Follow-on Investments. Explain how a subsequent investment could follow after the program.

- Value Creation. Show how the valuation of a company developed before and one year after the program.

- Acceptance rate. The relation between those startups accepted for the program and the number of applications.

- Alumni. Show the number of startups that already finished the program.

- Number of Companies active or acquired. Show the number of startups that maintained their business activity, whether they are generating revenue as a privately held entity or got acquired after the program.

For non-equity programs, in particular, it makes sense to add specific KPIs such as generated “media value” or “recurring business relations”. Most corporates apply quantitative and quality driven KPIs (internally) in addition, as they normally have to proof to their management a positive cultural impact (e.g. a grassroots effect), higher productivity, shorter innovation cycles, saved the cost of innovation, or additional learnings stimulated. Startups may ask how a corporate measures the success of a certain program internally – don’t be afraid to answer this question. (see Value #2 “Be Transparent”).

Innovation challenges are a good start

One example how corporates may launch startup engagement activities without any risks and at low costs are startup challenges such as “Innovation to Company” (I2C). Together with the Vienna Chamber of Commerce as well as Maximilian Lammer and Martin Giesswein we are proud co-creators and mentors of this program. Venionaire is also the key partner when it comes to scouting and analyzing the startups.

I2C is designed as a non-equity, collaboration-focused, accelerator program, which has been ruling out prices. Besides cash, the biggest advantage for founders is to have one foot in the door of large corporate partners, which is likely to trigger significant business traction and will help them to gain market trust. Looking at the standard KPIs of I2C, we are proud of how this program has developed, but we are working hard to improve every year.

KPIs of Innovation to Company:

- Media Publicity: media value generated per company > EUR 25.000 through a media partnership with derbrutkasten.com

- Recurring business relations with corporate partners developed: > 80%

- Value Creation (after 12 months of the program): Up to EUR 4,16 million

- Follow-on Funding: > EUR 3 million

- Acceptance Rate: 2 – 3%

- Companies active: 100%

- Companies acquired: None yet.

Programs such as Innovation to Company help startups to accelerate their business to the next level.

Conclusion

The ways of engagement with startups are various. Therefore, the design of the program should be carefully chosen, aligned with clearly set objectives and importantly, living up to the standards of pre-defined values. Constant communication, agility, and selection of the right partners are key to a good start for corporate startup engagement programs.

Although a division provides clear boundaries among the categories, it is important to have in mind, that the changes in objectives and overall conditions can easily blur the lines when configuring the right framework. One of the decisive success factors for CSE programs is applied flexibility and the understanding that all efforts are in some way an investment into short or long-term future. This is often a pain for large, complex systems such as corporates. Therefore, our holistic approach provided in this article can represent a form of a guideline in building winning programs.

Venionaire Capital is an experienced partner when it comes to developing or setting up corporate startup engagement programs. We would be happy to tell you more in person (please contact us here for any questions.)