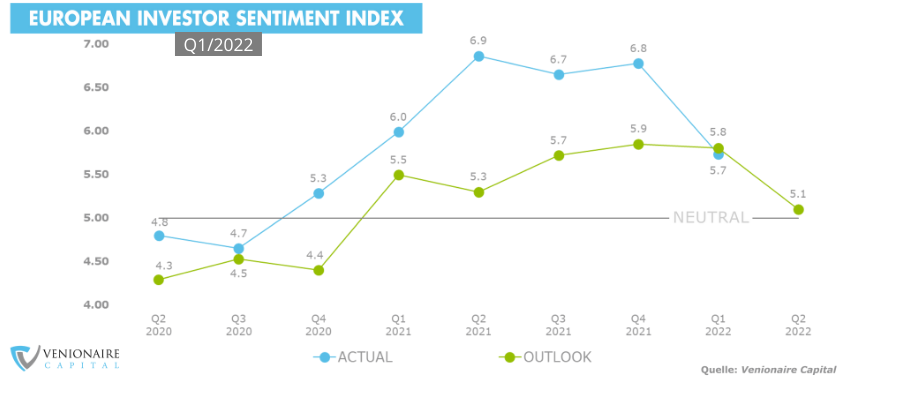

A SHARP DROP IN THE INDEX ACTUAL AND THE OUTLOOK FOR Q2

The venture sentiment decreased significantly from Q4 of 2021 but remained in positive territory.

Overview

At the beginning of this year, it became clear that the post-pandemic recovery trend would likely not continue due to sudden and drastic changes in the geopolitical landscape. The consequences of the global COVID-19 pandemic receded into the background. Meanwhile, the war in Ukraine, the consequent sanctions on Russia and supply shortages have shaken up Europe’s economic, political and economic scene. There is outstanding pressure on Europe in terms of demand, inflation, and energy security which has given another push to sustainability startups (Dealroom, 2022). The price of Brent and the global price benchmark for crude oils experienced an unprecedented increase of 40%, reaching the USD 100 price per barrel which was long forgotten since 2013 (WorldBank, 2022).

In Q1 2022, we observed a strong decrease in venture sentiment. Even though investment volume in Europe continued to grow on both YoY and QoQ basis. Q1 2022 marked the first time since the start of the COVID pandemic that the index actual (5.74) is lower than the corresponding index outlook. High inflation, supply chain crisis, and war in Ukraine have substituted investors’ worries over the coronavirus and the index outlook has landed on 5.10, a -12.06% decrease and the lowest recorded value since Q4 2020. Even though the gap between actual and outlook has been closed for Q1 2022, there is still a gap between the current and the expected sentiment.

Topics covered in the latest report:

- European venture capital continues to deliver alpha amidst the post-COVID crisis and the ongoing war in Ukraine. Institutional investors are expressing willingness to increase their exposure to private markets.

- A strong decrease in investors’ sentiment for Q1 as well as their outlook for Q2. The gap between the index actual and the index outlook has started to close. Investors remain very sceptical about the future due to high inflation rates, supply chain shortages and the energy crisis.

- The energy crisis has given another push for sustainability startups. Europe is the global leader in sustainable startup investment.