Once confronted with the problem of evaluating an early stage company for the first time, you will find a number of valuation methods and sooner or later you will question yourself, which model does consider all the relevant factors.

The absence of comparable companies, the inexistence of historical data, the complexity to estimate volatility, and a large number of intangible assets, which unfortunately are key drivers for value in tech-related companies, make this discipline so difficult.

In fact, there is a simple answer: There are no precise valuations for early-stage companies. In most cases, professional VCs will, therefore, calculate a number of valuation models and scenarios and take a weighted average of them (depending on the estimated fit of the model to the underlying business case), as a starting point or an instrument for negotiations. A deal will eventually happen for a certain price (market price) and companies will also refer to this price as their “market-valuation”.

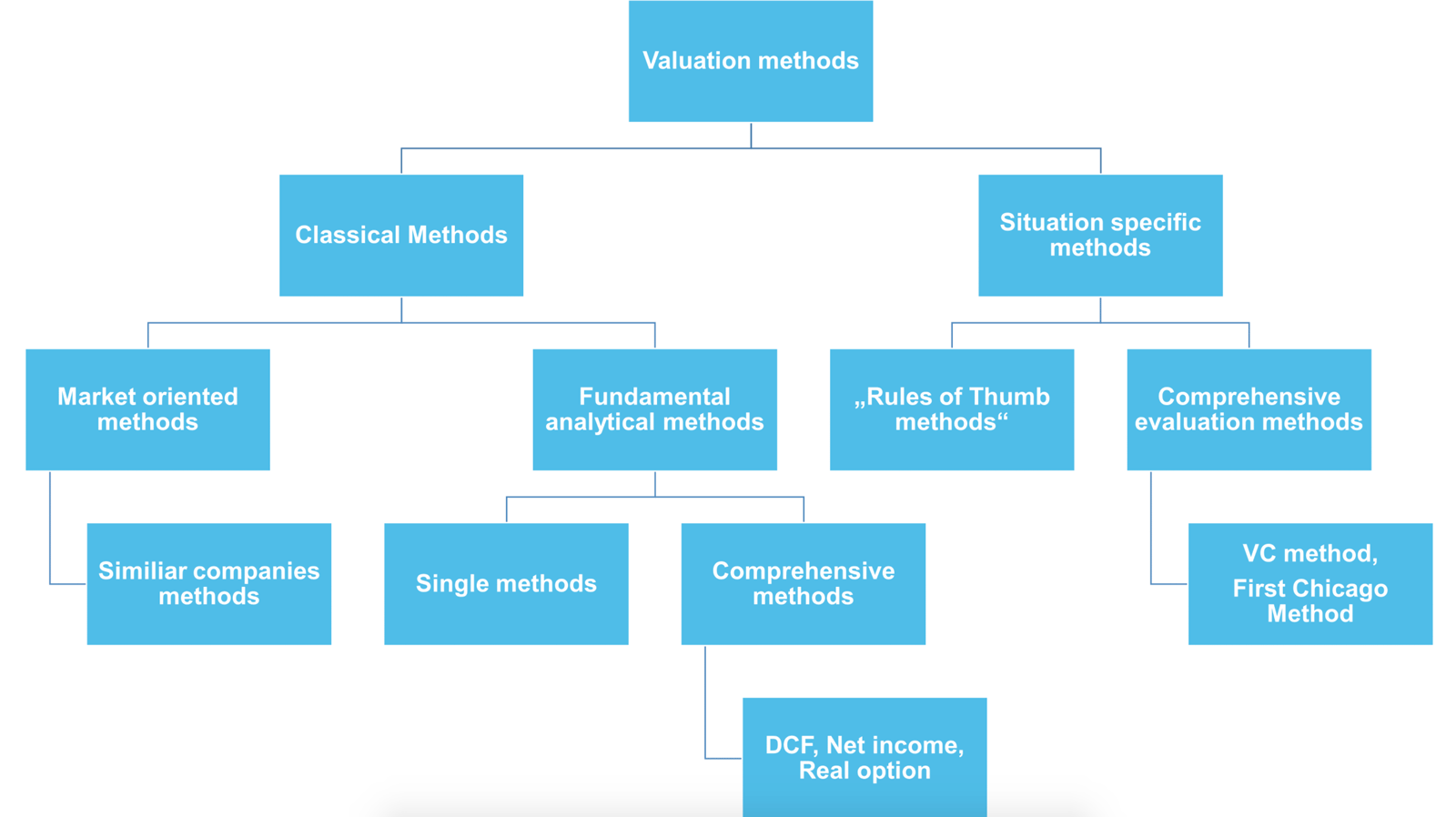

Let’s start with a little orientation:

Source: Achleitner, Nathasius (2003)

As already discussed in a previous article these Valuation methods belong to different concepts. In this article, we will focus on a comprehensive evaluation method, the so-called “First Chicago Method”. For a more easily done valuation method please head over to our article about the Venture Capital Method.

TRY DEALMATRIX.COM START-UP VALUATION CALCULATOR

-> Run your valuation <-

The First Chicago Method is a situation-specific business valuation approach used by venture capital and private equity investors for early-stage companies. This model combines elements of market-oriented and fundamental analytical methods. It is mainly used in the valuation of dynamic growth companies. Let’s go through this method step by step.

Step 1: Define different future scenarios for the Company

Usually, you create three scenarios for an enterprise:

– Best-case

– Mid-case

– Worst-case

First, you have to set up a financial forecast (including revenues, earnings, cash flows, exit-horizon etc.) for each case. A detailed qualitative analysis of the market trends and the company are necessary in order to estimate these scenarios. In general, the mid-case scenario is the expectation of an Analyst after the Due Diligence (DD).

Hence, in many businesses, which are mainly driven by the scalability factor (e.g. the market is in a “winner takes it all” situation), it is reasonable to set the worst-case equivalent to the event of a total loss of the invested capital. Then again there are businesses where the market determines a natural maximum cap of the financial outcome.

Still, step 1 is not easy to master and needs extensive analytical research of the circumstances. You might even have the freedom to consider strategy-shifts in your financial forecast depending on the assumptions of each case.

Step 2: Estimate divestment price for each scenario using multiples

After setting up your financial-forecast, you need to determine the Terminal Value (TV) at the time of the exit (divestment price). At this point, we apply a market-oriented valuation concept, Multiples. The idea is to estimate valuation by comparing the investment to other transaction within the same peer group. Peer groups in the venture industry are characterized by:

- Enterprise industry

- Enterprise stage

- Enterprise region

There are various forms of Multiples each suitable for different asset classes. Professionals in the venture industry will use Multiples based on KPIs like EBIT, Revenues etc. The critical factor in this market-oriented approach is the transaction data of the peer group. Data about M&A activity in the venture industry are rare, nevertheless, there are data providers on the market specializing in the venture industry.

Step 3: Determine required return and calculate valuation for each scenario

Many VCs determine the required return internally. They do not trust concepts like WACC (Weighted Average Cost of Capital) and CAPM (Capital Asset Pricing Model) due to of the incompleteness of the private equity market (you can’t replicate the payoff of an investment with a portfolio of assets). However, we will give a brief introduction into the WACC concept which is adjustable to the venture market. Furthermore, we will assume the absence of debt capital in the financial forecasts, which reduces the WACC to the cost of equity (not a strong assumption approaching the valuation of early-stage companies).

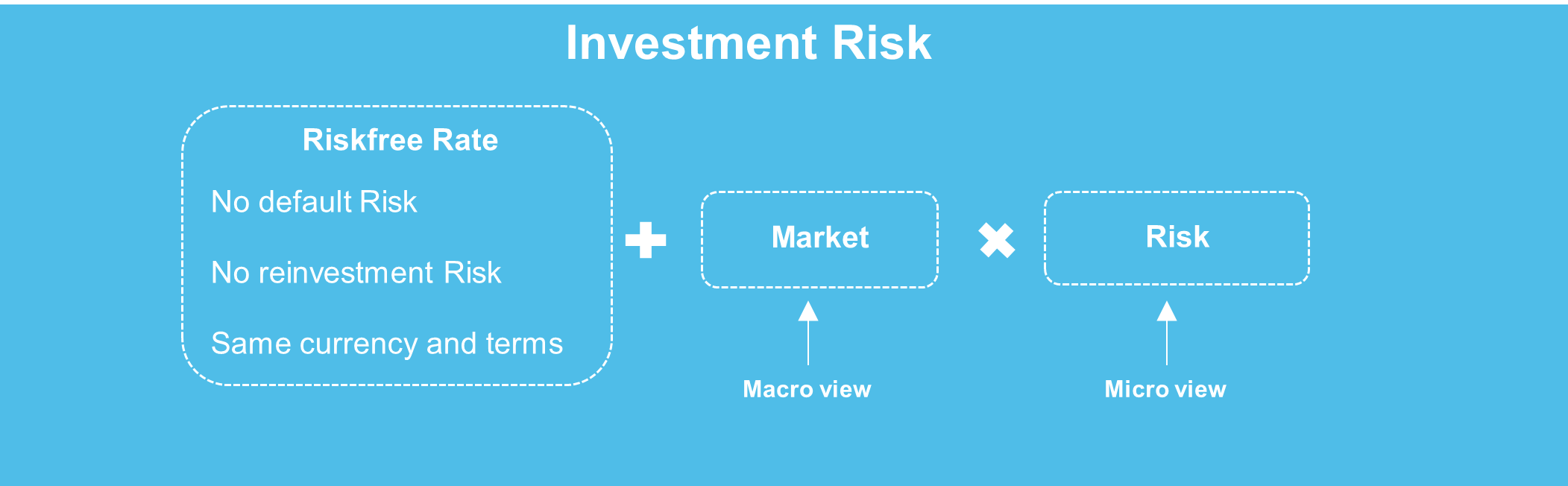

Source: Damodaran (2009)

Estimating market risk for the industry, stage and region and determining a risk premium individually for each company are key factors.

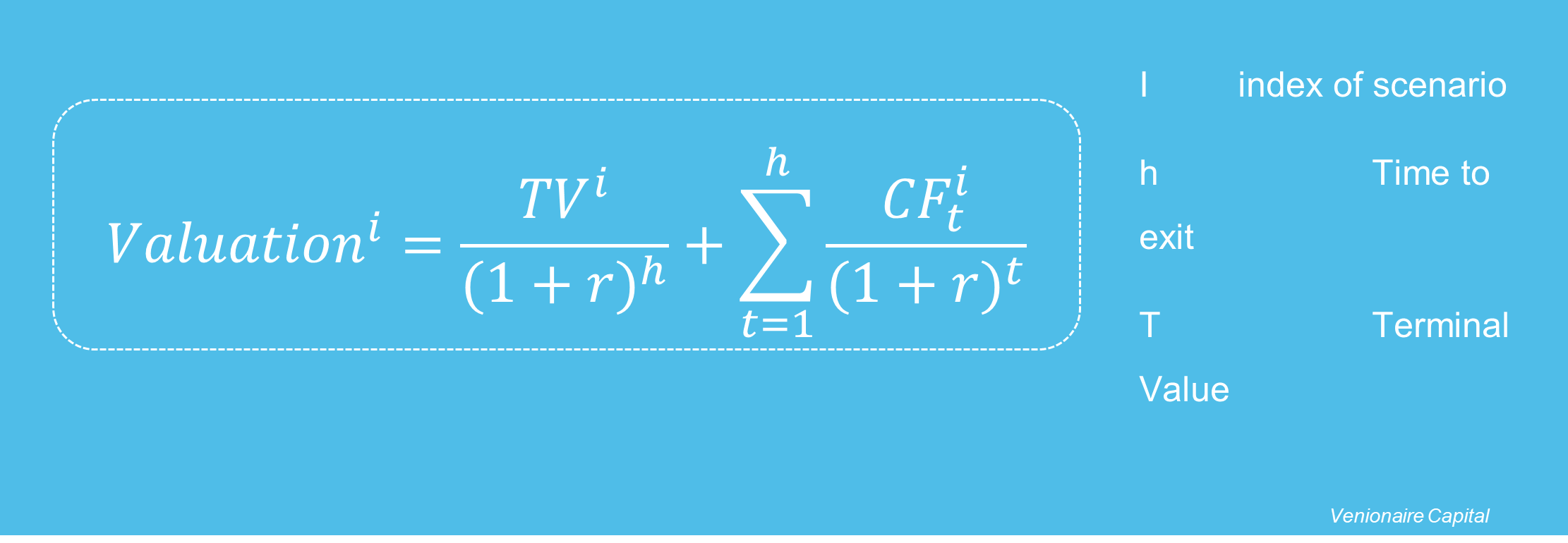

The valuation for each scenario is the sum of the discounted Terminal value and the discounted cash flows until the exit-horizon.

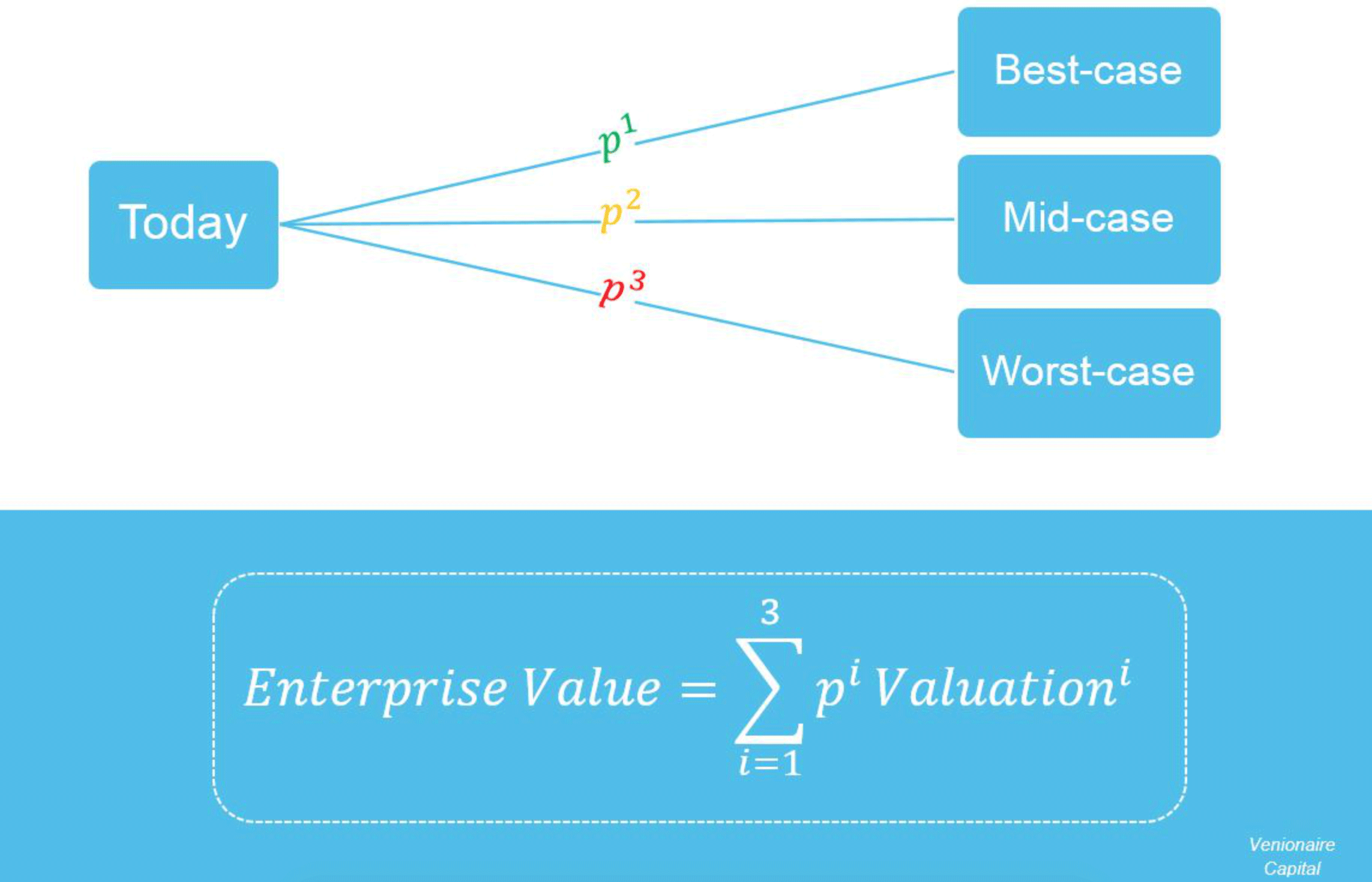

Step 4: Estimate probabilities of scenarios and calculate the weighted sum

For this last step, you have to allocate a probability to each scenario. These probabilities are naturally correlated to your definition of the scenarios and the number of them. Of course, it is impossible to estimate precise probabilities for every scenario. The idea is to take extreme outcomes into your valuation process.

At the end calculate the weighted sum of the valuations depending on each scenario.

Source: Venionaire Capital (2015)

The First Chicago Method is a technique of wide scope. Step 1 gives you the freedom and the opportunity to consider events with low probability but a huge impact on your investment pay off. On the other side, this freedom brings more complexity to your valuation framework. We at Venionaire Capital don’t fear the additional effort. We are specialized in a comprehensive analysis of tech-related young companies and screen every company until we get a clear picture of all possibilities.

At Step 2 we use dataflow through our cooperation partners and professional data providers. The choice of the multiple depends on the peer group and the structure of the enterprise. Due to our long experience in this sector, we developed an advanced framework for clustering the Startups.

At Step 3 we investigate the market through a short-term analysis focusing on the potential of the Business case and a long-term analysis to identify fundamental market trends. Our analysis includes all aspects of the Enterprise which will be considered based on their impact in the specific Company-peer group.

TRY OUR START-UP VALUATION CALCULATOR

Run your valuation – 100% free

Estimating the probabilities of the scenarios is a challenging task and seems arbitrary at a first glance. Nevertheless, they are various mathematical approaches to overcome this problem, addressing the extreme possible scenarios and assuming fat-tailed and highly skewed distributions for the underlying risk-drivers of the business. Furthermore, there is uncertainty in estimating the exit horizon because private companies are infrequently traded assets.

Join our Investor Community!

Venionaire Capital is co-founder of the “European Super Angels Club”. If you liked this article, please follow us on LinkedIn for more insight articles and news.